Increased Remote Work Culture

The shift towards remote work has significantly influenced the unified communication-service market in Japan. As organizations adapt to flexible work arrangements, the demand for reliable communication tools has escalated. Companies are increasingly investing in unified communication solutions that facilitate seamless collaboration among remote teams. This trend is reflected in a survey indicating that over 70% of Japanese companies have adopted some form of remote work policy. Consequently, the market is witnessing a notable increase in the adoption of video conferencing, instant messaging, and collaborative platforms. This shift not only enhances productivity but also fosters a culture of inclusivity, allowing employees to connect regardless of their physical location.

Growing Demand for Integrated Solutions

The unified communication-service market in Japan is witnessing a growing demand for integrated solutions that combine various communication channels into a single platform. Businesses are increasingly recognizing the benefits of having a unified interface for voice, video, and messaging services. This integration simplifies communication processes and enhances operational efficiency. According to recent data, approximately 60% of organizations in Japan are prioritizing the adoption of integrated communication solutions. This trend is likely to continue as companies seek to streamline their operations and reduce costs associated with managing multiple communication tools. The market's evolution towards integrated solutions indicates a shift in how businesses approach communication, emphasizing the need for cohesive and efficient systems.

Regulatory Compliance and Data Security

The unified communication-service market in Japan is significantly influenced by the need for regulatory compliance and data security. As businesses increasingly rely on digital communication, ensuring the protection of sensitive information has become paramount. The Japanese government has implemented stringent regulations regarding data privacy, compelling organizations to adopt secure communication solutions. This regulatory landscape is driving the demand for unified communication services that offer robust security features, such as end-to-end encryption and secure access controls. As of 2025, it is estimated that compliance-related investments in communication technologies will account for nearly 30% of the market's growth, highlighting the critical importance of security in shaping the future of communication services.

Focus on Customer Experience Enhancement

Enhancing customer experience is becoming a pivotal driver for the unified communication-service market in Japan. Organizations are increasingly leveraging communication tools to improve customer interactions and satisfaction. The integration of customer relationship management (CRM) systems with communication platforms allows businesses to provide personalized services, which is essential in a competitive landscape. Recent studies suggest that companies that prioritize customer experience see a 20% increase in customer retention rates. This focus on customer-centric communication strategies is likely to propel the growth of the unified communication-service market, as businesses strive to meet the evolving expectations of their clientele.

Technological Advancements in Communication

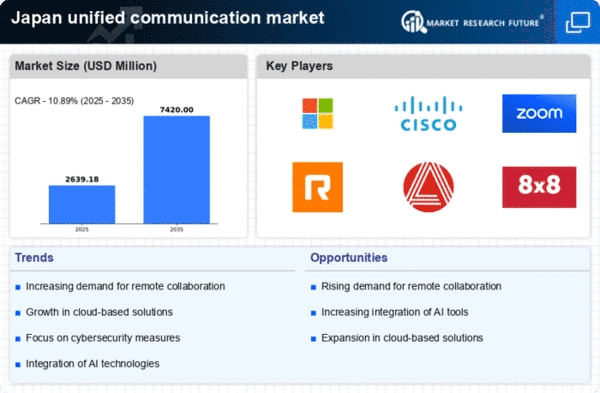

The unified communication-service market in Japan is experiencing a surge due to rapid technological advancements. Innovations in artificial intelligence (AI) and machine learning are enhancing communication tools, making them more efficient and user-friendly. For instance, AI-driven chatbots and virtual assistants are streamlining customer interactions, which is crucial for businesses aiming to improve service delivery. Furthermore, the integration of advanced analytics allows organizations to gain insights into communication patterns, thereby optimizing their strategies. As of 2025, the market is projected to grow at a CAGR of approximately 15%, driven by these technological enhancements. This growth indicates a robust demand for sophisticated communication solutions that can adapt to the evolving needs of businesses in Japan.