Rising Security Concerns

The increasing prevalence of security threats in Japan has led to a heightened demand for surveillance solutions. As incidents of crime and vandalism rise, businesses and public institutions are increasingly turning to the video surveillance-as-a-service market for effective monitoring solutions. This trend is underscored by a report indicating that the market is projected to grow at a CAGR of 15% over the next five years. Organizations are recognizing the need for real-time surveillance to protect assets and ensure safety, which is driving investments in video surveillance-as-a-service solutions. The ability to access high-quality video feeds remotely enhances situational awareness, making it a critical component of modern security strategies. Consequently, the video surveillance-as-a-service market is positioned to expand significantly as stakeholders prioritize safety and security in their operational frameworks.

Technological Advancements

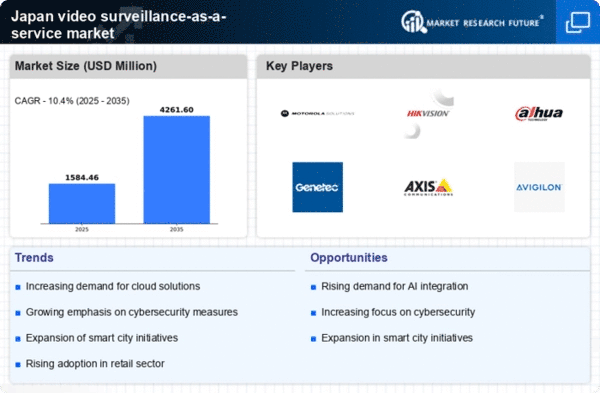

The rapid evolution of technology is a key driver for the video surveillance-as-a-service market in Japan. Innovations in cloud computing, artificial intelligence, and machine learning are transforming how surveillance systems operate. These advancements enable features such as facial recognition, motion detection, and advanced analytics, which enhance the effectiveness of surveillance solutions. The integration of these technologies allows for more efficient data management and storage, reducing the need for extensive on-premises infrastructure. As a result, organizations are increasingly adopting video surveillance-as-a-service models that leverage these technologies. The market is expected to witness a growth rate of approximately 20% in the next few years, as businesses seek to capitalize on the benefits of advanced surveillance capabilities. This trend indicates a shift towards more intelligent and responsive security systems, further propelling the video surveillance-as-a-service market.

Regulatory Compliance Requirements

In Japan, stringent regulatory frameworks regarding data protection and privacy are influencing the video surveillance-as-a-service market. Organizations are required to comply with laws such as the Act on the Protection of Personal Information, which mandates the responsible handling of personal data. This regulatory environment is driving businesses to adopt video surveillance-as-a-service solutions that offer built-in compliance features. By utilizing these services, organizations can ensure that their surveillance practices align with legal requirements, thereby mitigating the risk of penalties. The market is likely to see an increase in demand for solutions that provide transparency and accountability in data handling. As compliance becomes a priority, the video surveillance-as-a-service market is expected to grow, with businesses seeking to implement systems that not only enhance security but also adhere to regulatory standards.

Increased Demand for Remote Monitoring

The demand for remote monitoring capabilities is significantly influencing the video surveillance-as-a-service market in Japan. As businesses and institutions seek to enhance their security measures, the ability to monitor premises from remote locations has become increasingly vital. This trend is particularly relevant in a country where many organizations operate across multiple sites. Remote access to surveillance feeds allows for real-time monitoring and rapid response to incidents, thereby improving overall security management. The video surveillance-as-a-service market is expected to grow as organizations prioritize solutions that offer robust remote monitoring features. This demand is further fueled by the increasing reliance on mobile devices and applications, which facilitate easy access to surveillance data. Consequently, the market is likely to see a surge in adoption as stakeholders recognize the value of remote monitoring in enhancing security operations.

Cost-Effectiveness of Subscription Models

The shift towards subscription-based models in the video surveillance-as-a-service market is gaining traction in Japan. This approach allows organizations to access advanced surveillance technologies without the burden of significant upfront capital expenditures. By opting for a subscription model, businesses can allocate resources more efficiently, as they pay only for the services they use. This flexibility is particularly appealing to small and medium-sized enterprises that may have limited budgets for security solutions. The video surveillance-as-a-service market is projected to expand as more organizations recognize the financial benefits of this model. Additionally, the ability to scale services according to changing needs further enhances the attractiveness of subscription-based offerings. As a result, the market is likely to experience sustained growth driven by the cost-effectiveness of these models.