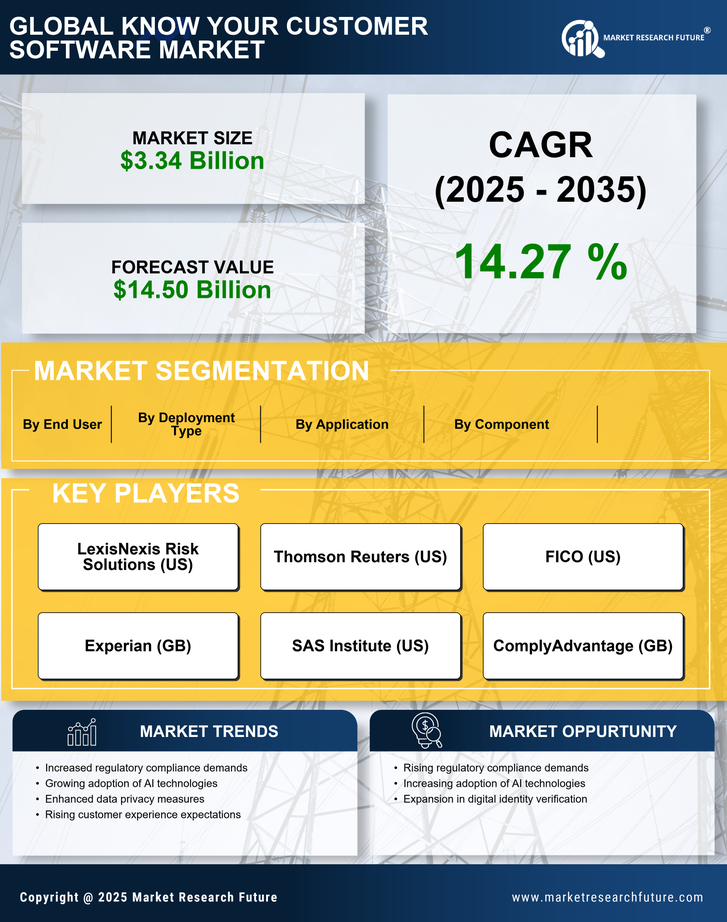

Regulatory Compliance Focus

The Know Your Customer Software Market is experiencing a heightened emphasis on regulatory compliance. Financial institutions and businesses are increasingly required to adhere to stringent regulations aimed at preventing money laundering and fraud. This has led to a surge in demand for KYC solutions that can efficiently verify customer identities and monitor transactions. According to recent data, the compliance technology market is projected to grow significantly, with KYC software being a critical component. As regulations evolve, organizations are compelled to invest in advanced KYC solutions to mitigate risks and ensure compliance, thereby driving growth in the Know Your Customer Software Market.

Customer Experience Enhancement

Enhancing customer experience is becoming a pivotal driver in the Know Your Customer Software Market. Organizations are recognizing that a seamless and efficient KYC process can significantly improve customer satisfaction and retention. By leveraging technology to simplify identity verification, businesses can reduce onboarding times and create a more user-friendly experience. Recent studies indicate that companies investing in customer-centric KYC solutions are likely to see a positive impact on their overall performance. As competition intensifies, the focus on customer experience is expected to drive innovation and investment in KYC software, further propelling the growth of the Know Your Customer Software Market.

Increased Cybersecurity Threats

The rise in cybersecurity threats is a critical driver for the Know Your Customer Software Market. As digital transactions become more prevalent, the risk of identity theft and fraud has escalated, prompting organizations to prioritize robust KYC solutions. Companies are increasingly aware that inadequate KYC measures can expose them to significant financial and reputational risks. Market analysis indicates that the demand for KYC software is likely to grow as businesses seek to fortify their defenses against cyber threats. This heightened focus on security not only drives the adoption of KYC solutions but also encourages continuous innovation within the Know Your Customer Software Market.

AI and Machine Learning Integration

The integration of artificial intelligence and machine learning technologies is transforming the Know Your Customer Software Market. These advanced technologies enable organizations to analyze vast amounts of data quickly and accurately, enhancing the efficiency of customer verification processes. AI-driven KYC solutions can identify patterns and anomalies that may indicate fraudulent activities, thus improving risk management. Market data suggests that the adoption of AI in compliance solutions is expected to increase, with a notable rise in the use of predictive analytics. This trend not only streamlines operations but also enhances the overall effectiveness of KYC processes, contributing to the growth of the Know Your Customer Software Market.

Globalization of Financial Services

The globalization of financial services is significantly influencing the Know Your Customer Software Market. As businesses expand their operations across borders, they face the challenge of complying with diverse regulatory requirements in different jurisdictions. This complexity necessitates the implementation of comprehensive KYC solutions that can adapt to various legal frameworks. Market trends suggest that the demand for KYC software will continue to rise as organizations seek to streamline their compliance processes in an increasingly interconnected world. The ability to efficiently manage KYC requirements across multiple regions is becoming a key competitive advantage, thereby driving growth in the Know Your Customer Software Market.