Labeling Equipment Size

Labeling Equipment Market Growth Projections and Opportunities

The Labeling Equipment Market is plagued by multiple market factors which synergistically contribute to the growing or declining of this industry. Among the many determining elements is that customer tastes constantly evolve and give rise to the need for customization. As consumers begin to become more discerning, board of the industries in general crazes with labeling equipment able to designate for adaptive pack and personalized. This turn has increased the demand for advanced labeling techniques requiring digital printing and smart labeling which are able to suit the changing types and complexities of packaging.

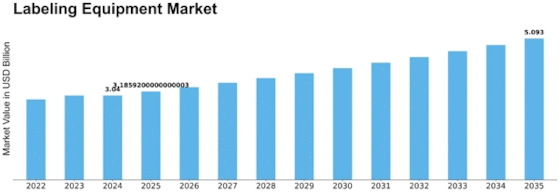

The Size of the Back Labeling Equipment Market is estimated to be valued at USD 2.8 Billion in 2022. The market for production and packaging equipment is likely to be going from USD 2.9 Billion in 2023 to USD 4.2 Billion by 2032 at a 4.80% compound annual growth rate (CAGR).

As for the FMCG industry, consumer preferences tend to change with the development of time. Besides this, regulatory compliance is the another significant factor that is shaping the labeling market. Since the requirements for labeling of products belonging to such industries as pharmaceuticals and food and beverage are the most rigid and exclusive ones, technical innovation has been employed to ensure the use of sophisticated labeling methods. Several industries engaged in the areas require the labeling machines that ensure the precision conformity and title-tracking to meet the strict legislative requirements. Consequently, this has brought manufacturers to theircreative mode to develop solutions that not only increases their efficiency but alsocompliance with regulations.

The globalized trade and commerce of the products have diversified have the largest influence on the mark labeling equipment production market. Companies, embracing the scope of their operation, come across the labeling requirements relating to each country and region that have unique labeling requirements. This has therefore created customers for the machine that can do multi-language labels, compliant with the respective regional standards, and versatile enough to match different packaging formats. Manufacturers within the labeling equipment are therefore involved in the process of the production of flexible solutions for labeling which can meet the complexities of the supply chains that spans a global environment.

Also, there is a growing tendency to pay more attention to sustainability and eco-friendliness and this can have a considerable impact on the labeling equipment market. Companies are increasingly opting for “green” labeling solutions to ensure chemical framework compliance, and also in line with the modern consumer culture that prioritizes sustainability practices. The demand for recycling processes has given rise to machinery that allows apparatus to work with recyclable materials, reduce energy and waste and is also energy saving. The sustainability issue that is becoming a major concern for companies worldwide is evidently leading to the changing development of the equipment for labeling market, which is now being presented in green, eco-conscious means of production.

.

Leave a Comment