Growing Biopharmaceutical Sector

The biopharmaceutical sector is witnessing rapid expansion, which is significantly impacting the Laboratory Equipment and Disposables Market. As the demand for biologics and biosimilars increases, laboratories require advanced equipment for research, development, and production processes. This surge in biopharmaceutical activities is expected to drive the market for laboratory equipment, with projections indicating a growth rate of approximately 8% in this segment over the next few years. The need for specialized disposables, such as single-use bioreactors and sterile filtration systems, is also on the rise, as they facilitate efficient and safe production processes. This trend underscores the importance of the laboratory equipment market in supporting the biopharmaceutical industry's growth.

Increased Focus on Quality Control

Quality control remains a critical aspect of laboratory operations, significantly influencing the Laboratory Equipment and Disposables Market. As regulatory standards become more stringent, laboratories are compelled to adopt advanced equipment and disposables that ensure compliance and reliability. This heightened focus on quality assurance is driving the demand for sophisticated testing and analytical instruments. Market data indicates that the quality control segment is likely to experience a growth rate of around 5% annually, reflecting the necessity for laboratories to maintain high standards in their operations. Consequently, manufacturers are investing in the development of innovative products that meet these evolving quality requirements, further propelling market growth.

Rising Demand for Advanced Research

The Laboratory Equipment and Disposables Market is experiencing a notable increase in demand for advanced research capabilities. This trend is driven by the growing need for innovative solutions in various sectors, including pharmaceuticals, biotechnology, and environmental science. As research institutions and laboratories strive to enhance their capabilities, the market for sophisticated laboratory equipment is projected to expand significantly. According to recent data, the laboratory equipment segment is expected to witness a compound annual growth rate (CAGR) of approximately 6.5% over the next few years. This growth is indicative of the increasing investments in research and development, which are essential for driving scientific advancements and improving healthcare outcomes.

Technological Advancements in Equipment

Technological advancements play a pivotal role in shaping the Laboratory Equipment and Disposables Market. Innovations such as automation, artificial intelligence, and advanced data analytics are transforming laboratory operations, enhancing efficiency and accuracy. For instance, automated liquid handling systems and smart laboratory instruments are becoming increasingly prevalent, allowing researchers to conduct experiments with greater precision and reduced human error. The integration of these technologies is expected to propel the market forward, with estimates suggesting that the automation segment alone could grow at a CAGR of 7% in the coming years. This trend not only streamlines laboratory processes but also supports the growing demand for high-throughput screening and data management solutions.

Emerging Markets and Increased Investment

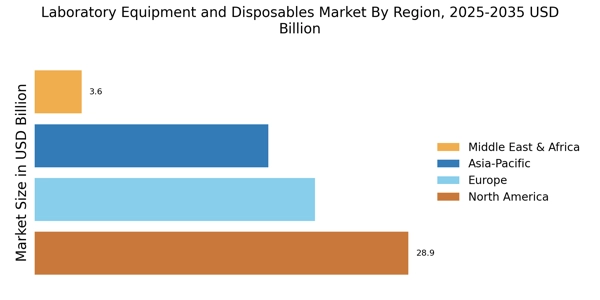

Emerging markets are becoming increasingly important in the Laboratory Equipment and Disposables Market, as they present new opportunities for growth. Countries in Asia-Pacific and Latin America are witnessing a surge in investments in research and development, driven by government initiatives and private sector funding. This influx of capital is fostering the establishment of new laboratories and research facilities, thereby increasing the demand for laboratory equipment and disposables. Market analysis suggests that the growth rate in these regions could reach 7% annually, as they strive to enhance their scientific capabilities. This trend not only benefits local economies but also contributes to the global advancement of scientific research and innovation.