Market Analysis

In-depth Analysis of Lactose Intolerance Treatment Market Industry Landscape

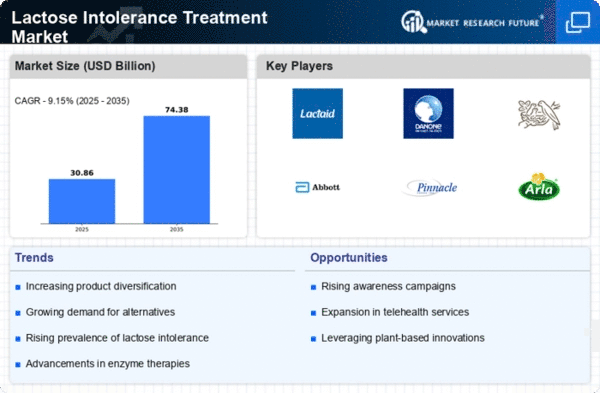

The market for lactose intolerance treatment has dynamic trends due to the prevalence of lactose intolerance evolving diagnostic approaches and increasing need for effective therapeutic solutions. Technological innovation is a major driver shaping dynamics in this market. The global burden that arises from lactase deficiency – a condition marked by an inability to digest milk sugar- constitutes some of the factors influencing growth as well as change within this marketplace. As individuals become more aware of being lactose intolerant, there will be increased medical consultations concerning gastrointestinal problems, hence leading to demand for accurate diagnostics tests with reasonable cost implications and workable treatment options. The variances in signs of lactase intolerance that could range from mild to severe gastrointestinal symptoms necessitate an individualized, friendly approach. Regulatory factors play a crucial role in shaping the dynamics of the lactose intolerance treatment market. This implies that some strict guidelines and regulations control the approval, labeling, and marketing of lactose-free products and therapeutic interventions to ensure their safety and effectiveness. Economic factors also influence the market dynamics alongside healthcare reimbursement policies. In this regard, costs associated with health care for lactase deficiency, the availability of diagnostic tests, and affordable treatments have an effect on their adoption by medical practitioners and individuals alike. Reimbursement policies determine acceptance of gastrolactase deficiency cures, including its application. The cost-effectiveness and accessibility of lactose-free products and therapeutic interventions are critical for widespread adherence to treatment plans. The dynamics of the treatment market for lactose intolerance are driven by competition among major players. Manufacturers seek to differentiate their products based on factors such as effectiveness, taste, convenience, and fitting different levels of lactose intolerance. The main focus in research and development includes making lactose-free products more pleasant, increasing the stability of lactase supplements, and exploring other therapeutic methods. The COVID-19 pandemic has influenced the dynamics of the lactose intolerance treatment market by highlighting the importance of digestive health and nutritional considerations. A growing focus on home-based solutions and use of digital health platforms has increasingly shaped lifestyle management of Lactose Intolerance. This has accelerated trends in online health consultations, telehealth support for dietary management, and the adoption of lactose-free products as part of a health-conscious lifestyle due to the COVID-19 pandemic.

Leave a Comment