Market Trends

Key Emerging Trends in the Lactose Intolerance Treatment Market

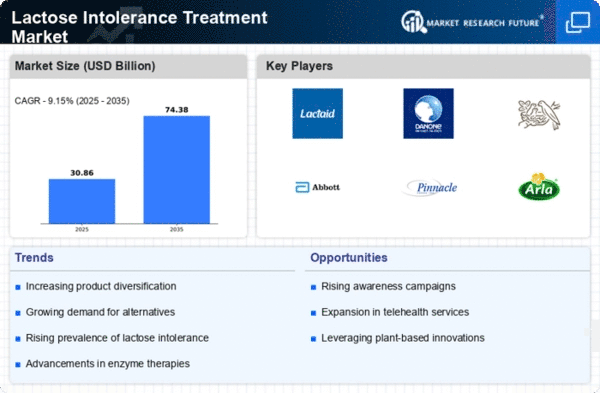

The current trend in the lactose intolerance treatment market reflects its transformational growth following increased awareness about it as an existing condition together with changing strategies regarding handling it. One remarkable development is that many people now use Lactase supplements as a primary approach to dealing with this condition. This enzyme is often deficient in individuals suffering from lactose intolerance because it helps break down this sugar when consumed. Additionally, there is an emphasis on developing foodstuffs that are either low or free from glucose molecules. To cater to these people's needs, food companies have come up with several alternatives to dairy products, especially those formulated without any traces of LPD components. This trend demonstrates how individuals can maintain balanced diets while avoiding foods that contain milk sugars, thereby giving rise to less severe symptoms. Furthermore, probiotics and prebiotics have emerged as potential therapeutic options for treating lactose-intolerant patients within the past few years. Prebiotics nourish healthy gut bacteria, while probiotics provide beneficial bacteria that boost the breakdown or digestion process, hence reducing the occurrence rate or severity level associated with LPD (Lactose Consumption). Also, there is a growing trend towards more informed patients. As knowledge about lactose intolerance expands, healthcare professionals and advocacy groups are stressing the importance of correct diagnosis and effective management. Education programs seek to teach individuals about diets, medications, and other ways to change their lives so that they can better control this condition. Moreover, there has been an increasing trend towards genetic testing for lactose intolerance predisposition. By using genetic testing, individuals can determine if they have a chance of developing LPD due to their genes, as well as make wiser food choices. This reflects the movement toward personalized medicine, which allows people to take a proactive approach with respect to healthcare based on their genetics. Furthermore, alternatives made from plants are gaining considerable popularity in the lactose intolerance treatment market. With the rise of plant-based diets and an increasing awareness of environmental sustainability, individuals with lactose intolerance are turning to non-dairy alternatives made from soy, almond, coconut, and other plant sources. The trend is harmonious with the general consumer switch toward vegetable eating habits as well as the availability of diverse non-dairy palatable options in the marketplace.

Leave a Comment