Laminated Busbar Size

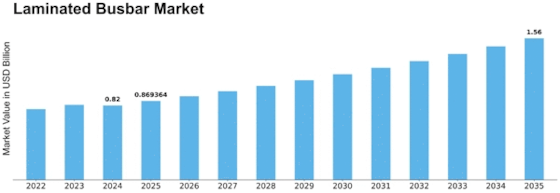

Laminated Busbar Market Growth Projections and Opportunities

The laminated busbar market is influenced by a variety of market factors that play a crucial role in shaping its dynamics. One key factor is the increasing demand for energy-efficient solutions across various industries. As global awareness of environmental issues grows, there is a growing emphasis on developing and adopting technologies that reduce energy consumption. Laminated busbars, with their ability to enhance the efficiency of power distribution systems, are gaining popularity as a preferred choice in the market.

Another significant market factor is the rapid expansion of the renewable energy sector. With a shift towards cleaner and sustainable energy sources, there is an escalating demand for laminated busbars in applications like solar inverters and wind power systems. The inherent advantages of laminated busbars, such as improved thermal performance and space optimization, make them an ideal choice for the evolving needs of the renewable energy market.

The automotive industry also contributes to the market factors shaping the laminated busbar market. The growing trend towards electric vehicles (EVs) and hybrid vehicles has led to an increased demand for laminated busbars in the automotive sector. Laminated busbars play a crucial role in electric powertrains, enabling efficient power distribution within the vehicle. As the automotive industry continues to transition towards greener technologies, the laminated busbar market is poised to witness significant growth.

Furthermore, advancements in technology and innovations in materials have a direct impact on the laminated busbar market. Manufacturers are continually investing in research and development to enhance the performance of laminated busbars by incorporating new materials and manufacturing techniques. This has led to the development of high-performance laminated busbars that offer improved electrical conductivity, thermal management, and durability.

The geographical factors also play a pivotal role in the laminated busbar market. The Asia-Pacific region, in particular, has emerged as a key contributor to the market growth. The rapid industrialization and infrastructural development in countries like China and India have led to an increased demand for laminated busbars in various applications, including power distribution, transportation, and renewable energy projects.

Market regulations and policies also influence the laminated busbar market dynamics. Government initiatives promoting energy efficiency and sustainability drive the adoption of laminated busbars in different sectors. Incentives and regulations that encourage the use of laminated busbars in power distribution systems contribute to the market's growth.

Additionally, the competitive landscape and market consolidation impact the dynamics of the laminated busbar market. The presence of key players in the market, along with mergers and acquisitions, influence pricing strategies and technological advancements. Market competition fosters innovation and drives manufacturers to develop cutting-edge laminated busbar solutions to stay ahead in the market.

The laminated busbar market is shaped by a combination of factors ranging from global trends in energy efficiency and renewable energy to technological advancements, regional developments, and market regulations. The increasing demand for efficient and sustainable power distribution solutions across various industries positions laminated busbars as a key component in the evolving landscape of electrical systems. As industries continue to prioritize energy efficiency and environmental sustainability, the laminated busbar market is expected to witness sustained growth in the coming years.

Leave a Comment