Research methodology on Laminated Bus Bar Market

Introduction:

The following research methodology is designed to examine the global market for laminated busbars by using a combination of both primary and secondary research. This research methodology is designed to review the market drivers and restraints of the laminated busbar market and provides a detailed analysis of its possible development in the near future. This methodology also aims to provide an overview of the current market size, trends, and growth opportunities in the laminated busbar market and to analyze the current state of the market.

Objective of the Study:

The main objective of the study is to estimate the market size of the global laminated busbar market and provide detailed insights into the market drivers, restraints, and trends that are affecting the market. The scope of the study is limited to qualitative and quantitative analysis of the market.

Research Design:

In order to accurately assess the current market situation and its projected development in the near future, a comprehensive research methodology is conducted. This research design includes the following steps:

1. Industry mapping and analysis:

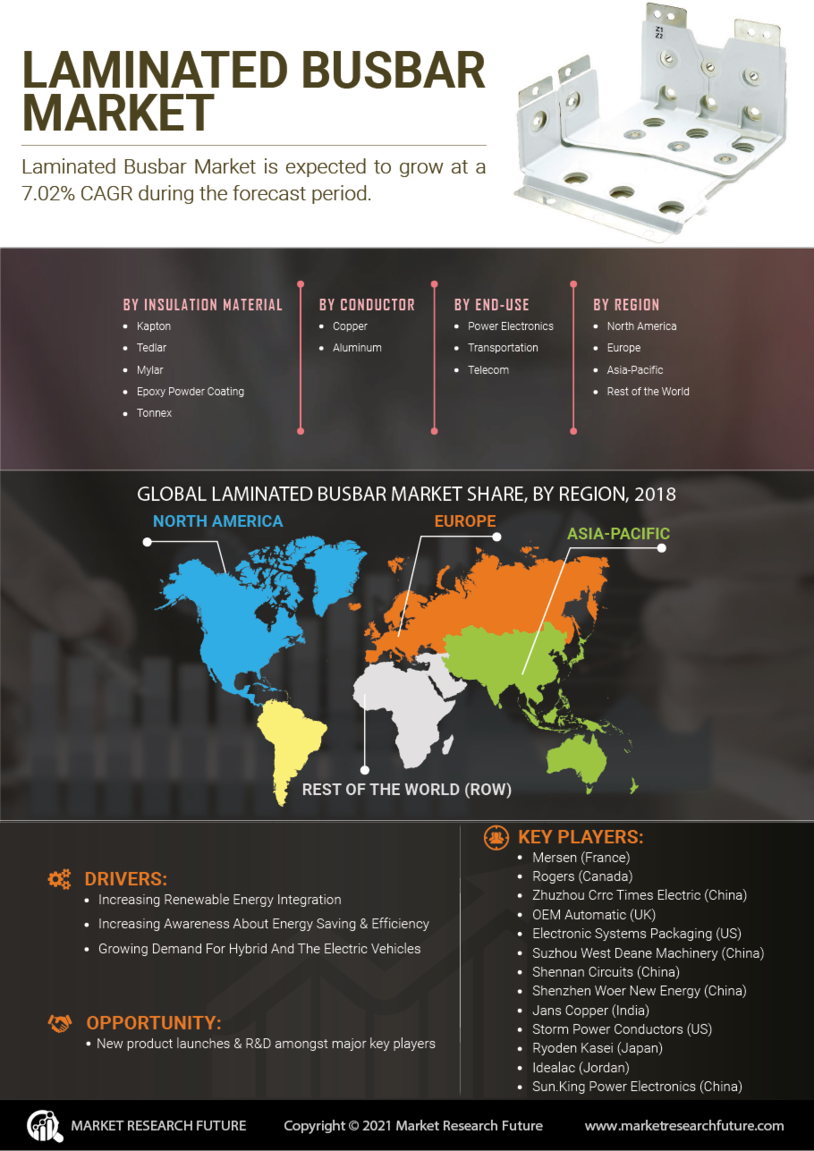

This step involves collecting and analyzing the data available on the competitive landscape of the global laminated busbar market. This includes studying the major players in the market, their financial performances, product portfolios, competitive strategies, and market presence across different geographical regions.

2. Market size and share assessments:

This step involves collecting and analyzing data on the market size and share of the global laminated busbar market in terms of revenue and volume. This data is collected from both primary and secondary sources. The primary sources include interviews with industry experts and market analysis firms. The secondary sources include company websites, financial reports, annual reports and journals, and other industry reports.

3. Market Dynamics:

This step involves examining the current market dynamics of the global laminated busbar market. This includes the analysis of the market drivers and restraints, potential opportunities, and competitive landscape. This data is collected from both primary and secondary sources. The primary sources include interviews with industry experts, market analysis firms, and companies. The secondary sources include company websites, financial reports, annual reports and journals, and other industry reports.

4. Regional Analysis:

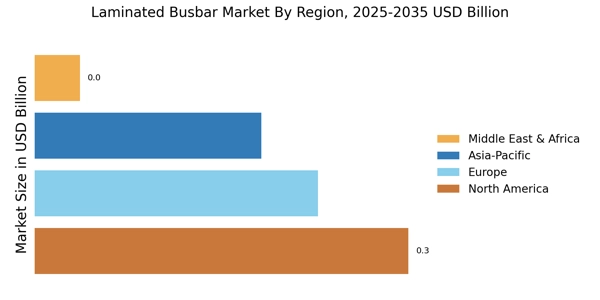

This step involves collecting and analyzing the data on the regional markets for laminated busbars. This includes studying the regional factors affecting the growth of the regional markets and analyzing the regional market trends. This data is collected from both primary and secondary sources. The primary sources include interviews with industry experts, market analysis firms, and companies. The secondary sources include company websites, financial reports, annual reports and journals, and other industry reports.

5. Market Forecast:

This step involves conducting a market forecast of the global laminated busbar market in terms of both value and volume. This data is collected from both primary and secondary sources. The primary sources include interviews with industry experts and market analysis firms. The secondary sources include company websites, financial reports, annual reports and journals, and other industry reports.

Research Scope:

The scope of the research is limited to providing an overview of the current market size, trends, and growth opportunities in the global laminated busbar market. The scope of the research focuses on both qualitative and quantitative analysis of the market.

Quantitative Analysis:

In order to quantify the global laminated busbar market, the research uses a combination of primary and secondary sources. Primary sources include interviews with industry experts, market analysis firms, and companies. The secondary sources include company websites, financial reports, annual reports and journals, and other industry reports. This data is analyzed and the market size has been estimated for the global laminated busbar market.

Qualitative Analysis:

In order to gain an in-depth understanding of the market, the research has used a combination of primary and secondary sources. Primary sources include interviews with industry experts and market analysis firms. The secondary sources include company websites, financial reports, annual reports and journals, and other industry reports. This data is analyzed to gain insights into the market dynamics, such as key market drivers and restraints, potential opportunities, and competitive landscape.

Conclusion:

The research has conducted a comprehensive analysis of the global market for laminated busbars. The scope of the study is limited to providing an overview of the current market size, trends, and growth opportunities in the global laminated busbar market. A combination of both primary and secondary sources is used to quantify and gain insights into the market dynamics. The analysis of this data is then used to estimate the size and growth of the global laminated busbar market. The research also provides an analysis of the regional markets for laminated busbars. This includes studying the regional factors affecting the growth of the regional markets and analyzing the regional market trends.