Growth in the E-commerce Sector

The Laminating Film Market is significantly influenced by the rapid expansion of the e-commerce sector. As online shopping continues to gain traction, the demand for protective packaging solutions, including laminating films, is expected to rise. E-commerce businesses prioritize the safe delivery of products, leading to an increased utilization of laminating films to ensure that packaging remains intact during transit. Recent data suggests that the e-commerce market is anticipated to grow by over 20% in the coming years, thereby creating a substantial opportunity for laminating film manufacturers to cater to this burgeoning demand.

Expansion of the Printing Industry

The Laminating Film Market is closely linked to the expansion of the printing industry, which is experiencing a renaissance due to digital transformation. As businesses increasingly invest in high-quality printed materials for marketing and branding purposes, the demand for laminating films that enhance the visual appeal and durability of printed products is likely to rise. The printing sector is projected to grow at a steady rate, with an emphasis on high-resolution and vibrant prints. This growth presents a significant opportunity for laminating film manufacturers to develop specialized products that cater to the evolving needs of the printing industry.

Increased Focus on Product Durability

In the Laminating Film Market, there is an increasing emphasis on product durability, which is driving the adoption of high-quality laminating films. Industries such as automotive, electronics, and food packaging are particularly focused on enhancing the longevity of their products through effective protective measures. The demand for laminating films that offer resistance to moisture, UV light, and abrasion is on the rise, as companies seek to improve the shelf life and performance of their products. This trend is likely to contribute to a steady growth trajectory for the laminating film market, as manufacturers innovate to meet these durability requirements.

Rising Demand for Packaging Solutions

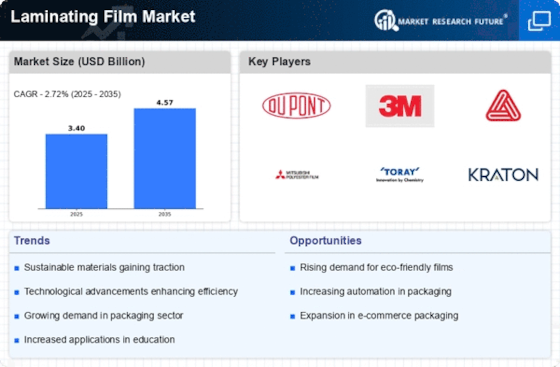

The Laminating Film Market experiences a notable surge in demand for packaging solutions, driven by the increasing need for product protection and shelf appeal. As consumer preferences shift towards visually appealing and durable packaging, manufacturers are compelled to adopt laminating films that enhance the aesthetic and functional qualities of their products. The packaging sector, which constitutes a significant portion of the laminating film market, is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is indicative of the broader trend towards sustainable and efficient packaging solutions, which further propels the laminating film market forward.

Technological Innovations in Film Production

The Laminating Film Market is witnessing a wave of technological innovations that are reshaping film production processes. Advancements in manufacturing techniques, such as the development of biodegradable laminating films and enhanced coating technologies, are enabling producers to offer more sustainable and efficient products. These innovations not only cater to the growing consumer demand for eco-friendly options but also improve the overall performance of laminating films. As a result, the market is expected to see a shift towards more advanced and versatile laminating solutions, which could potentially enhance market competitiveness and profitability.

.png)