Regulatory Support and Frameworks

The regulatory environment surrounding bioprocessing is evolving, with agencies providing clearer guidelines and support for the Large and Small Scale Bioprocessing Market. This regulatory clarity is essential for fostering innovation and ensuring product safety. Recent initiatives have focused on expediting the approval processes for biopharmaceuticals, which encourages investment in bioprocessing technologies. Moreover, regulatory bodies are increasingly recognizing the importance of bioprocessing in addressing public health challenges, leading to more favorable policies. This supportive framework is likely to enhance the confidence of stakeholders, thereby stimulating growth in the bioprocessing sector.

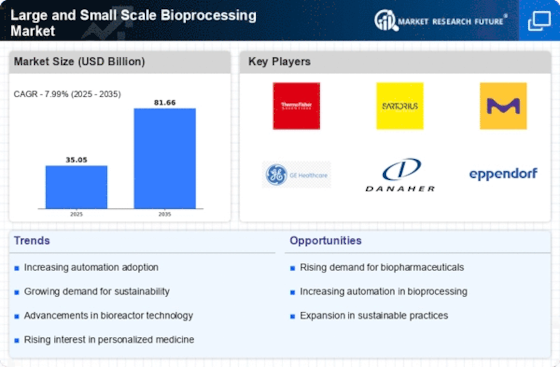

Rising Demand for Biopharmaceuticals

The increasing prevalence of chronic diseases and the aging population are driving the demand for biopharmaceuticals, which are produced through bioprocessing techniques. The Large and Small Scale Bioprocessing Market is witnessing a surge in the production of monoclonal antibodies, vaccines, and recombinant proteins. According to recent data, the biopharmaceutical sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This growth is largely attributed to the need for innovative therapies and the expansion of biologics in treatment protocols. As a result, bioprocessing technologies are being optimized to enhance yield and reduce production costs, thereby making them more accessible to a wider range of healthcare providers.

Advancements in Bioprocessing Technologies

Technological innovations in bioprocessing are transforming the landscape of the Large and Small Scale Bioprocessing Market. The introduction of automated systems, real-time monitoring, and advanced bioreactor designs are enhancing efficiency and scalability. For instance, single-use bioreactors are gaining traction due to their flexibility and reduced contamination risks. Furthermore, the integration of artificial intelligence and machine learning in bioprocess optimization is expected to streamline operations and improve product quality. These advancements not only facilitate faster production cycles but also enable manufacturers to respond swiftly to market demands, thereby positioning them favorably in a competitive environment.

Sustainability and Environmental Considerations

Sustainability is becoming a pivotal concern within the Large and Small Scale Bioprocessing Market. Companies are increasingly adopting eco-friendly practices to minimize their environmental footprint. This includes the use of renewable resources, waste reduction strategies, and energy-efficient processes. The shift towards sustainable bioprocessing not only aligns with global environmental goals but also appeals to consumers who are more conscious of the ecological impact of products. As a result, bioprocessing firms that prioritize sustainability are likely to gain a competitive edge, attracting investment and customer loyalty in an increasingly eco-aware market.

Growth of Contract Manufacturing Organizations (CMOs)

The rise of Contract Manufacturing Organizations (CMOs) is significantly influencing the Large and Small Scale Bioprocessing Market. CMOs provide essential services to biopharmaceutical companies, allowing them to outsource production and focus on core competencies such as research and development. This trend is particularly beneficial for small and medium-sized enterprises that may lack the resources for large-scale production. The CMO market is expected to expand as more companies seek to leverage external expertise and infrastructure, thereby enhancing their operational efficiency. This shift not only supports the growth of bioprocessing capabilities but also fosters innovation within the industry.