Increased Focus on Health and Wellness

The Large Kitchen Appliance Market is increasingly influenced by a growing focus on health and wellness among consumers. As individuals become more health-conscious, there is a rising demand for appliances that facilitate healthier cooking methods, such as steamers and air fryers. This trend is supported by Market Research Future indicating that health-oriented appliances are experiencing robust growth, with sales projected to rise significantly in the coming years. Manufacturers are responding by developing products that promote healthy eating habits, thereby tapping into this lucrative market segment. The emphasis on health and wellness is likely to remain a driving force in the Large Kitchen Appliance Market, as consumers seek appliances that align with their lifestyle choices.

Rising Consumer Demand for Energy Efficiency

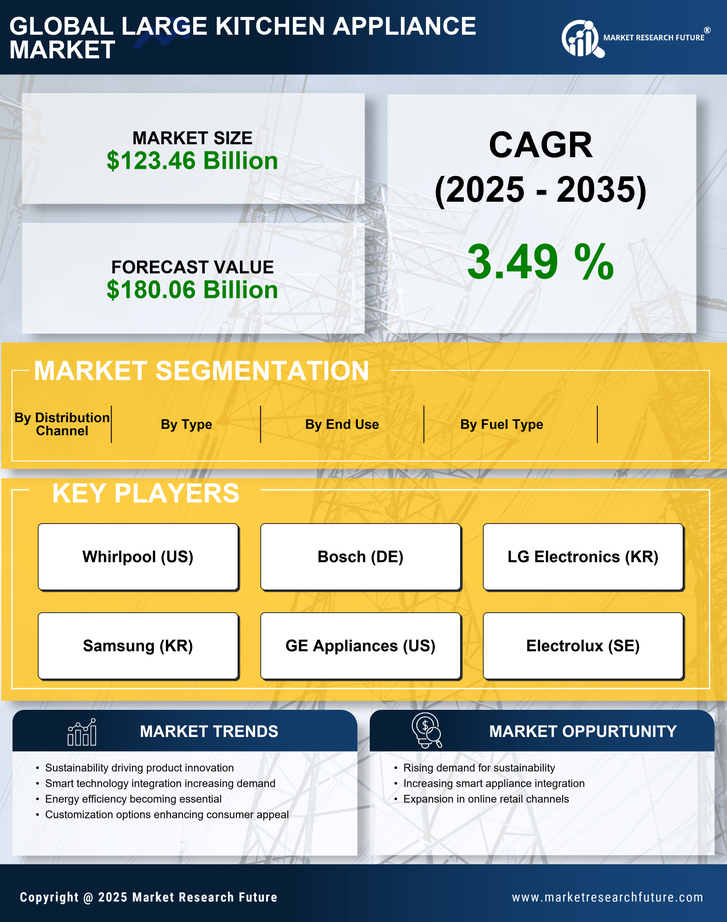

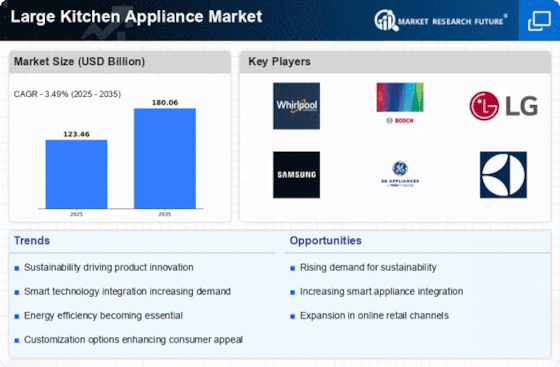

The Large Kitchen Appliance Market is experiencing a notable shift towards energy-efficient appliances. Consumers are increasingly prioritizing sustainability, leading to a surge in demand for products that minimize energy consumption. According to recent data, energy-efficient appliances can reduce energy use by up to 50%, which appeals to environmentally conscious buyers. This trend is further supported by government incentives promoting energy-efficient products, which enhance their attractiveness. As a result, manufacturers are investing in innovative technologies to meet this demand, thereby driving growth in the Large Kitchen Appliance Market. The emphasis on energy efficiency not only aligns with consumer preferences but also contributes to long-term cost savings, making it a pivotal driver in the market.

Technological Advancements in Appliance Features

Technological innovation plays a crucial role in shaping the Large Kitchen Appliance Market. The integration of smart technology, such as IoT connectivity and advanced automation, is transforming traditional appliances into multifunctional devices. For instance, smart refrigerators now offer features like inventory management and remote temperature control, enhancing user convenience. Market data indicates that the smart appliance segment is projected to grow significantly, with an expected compound annual growth rate of over 20% in the coming years. This technological evolution not only attracts tech-savvy consumers but also encourages manufacturers to differentiate their products, thereby intensifying competition within the Large Kitchen Appliance Market.

Shift Towards Compact and Multi-Functional Appliances

The Large Kitchen Appliance Market is adapting to changing consumer lifestyles, particularly in urban areas where space is often limited. There is a noticeable shift towards compact and multi-functional appliances that maximize utility without compromising on performance. For example, combination microwave ovens and washer-dryer units are gaining popularity among consumers seeking to optimize their kitchen space. Market data indicates that the demand for such appliances is on the rise, as they offer convenience and efficiency. This trend is likely to continue, prompting manufacturers to innovate and design products that cater to the needs of space-conscious consumers within the Large Kitchen Appliance Market.

Growing Interest in Home Cooking and Culinary Experiences

The Large Kitchen Appliance Market is witnessing a surge in interest related to home cooking and culinary experiences. As more individuals embrace cooking as a hobby, there is an increasing demand for high-quality kitchen appliances that enhance the cooking process. This trend is reflected in the rising sales of premium appliances, such as high-end ovens and mixers, which cater to the needs of home chefs. Market analysis suggests that this segment is likely to expand, driven by the desire for culinary creativity and the influence of social media platforms showcasing cooking techniques. Consequently, manufacturers are focusing on developing innovative products that appeal to this growing demographic within the Large Kitchen Appliance Market.