Technological Advancements in Laser Cladding

The Laser Cladding System Market is experiencing a surge in technological advancements that enhance the efficiency and precision of cladding processes. Innovations such as high-power lasers and advanced powder delivery systems are enabling manufacturers to achieve superior coating quality and faster processing times. These advancements not only improve the performance of cladded components but also reduce material waste, which is increasingly important in a resource-constrained environment. As a result, the market is projected to grow at a compound annual growth rate of approximately 7% over the next five years, driven by the need for high-performance materials in various applications. The integration of automation and artificial intelligence in laser cladding systems further streamlines operations, making them more attractive to industries seeking to optimize production efficiency.

Increasing Investment in Research and Development

Investment in research and development within the Laser Cladding System Market is fostering innovation and expanding application possibilities. Companies are allocating significant resources to develop new materials and improve existing cladding technologies, which is essential for meeting the evolving demands of various sectors. This focus on R&D is likely to result in breakthroughs that enhance the performance and versatility of laser cladding systems. As industries continue to explore new applications, such as in the energy sector for turbine coatings and in the oil and gas industry for pipeline repairs, the market is expected to see a robust growth trajectory. Analysts predict that R&D investments could lead to a market expansion of approximately 8% annually, as companies strive to maintain a competitive edge through technological advancements.

Focus on Sustainability and Eco-Friendly Solutions

Sustainability is becoming a central theme in the Laser Cladding System Market, as companies seek eco-friendly solutions to meet regulatory requirements and consumer expectations. Laser cladding processes are inherently more sustainable than traditional methods, as they minimize material waste and energy consumption. The ability to recycle and reuse materials in cladding applications further enhances the environmental appeal of these systems. As industries face increasing pressure to adopt greener practices, the demand for laser cladding systems is likely to rise. Market analysts suggest that the emphasis on sustainability could lead to a 10% increase in market growth over the next few years, as companies invest in technologies that align with their corporate social responsibility goals. This trend is particularly evident in sectors such as energy and manufacturing, where sustainable practices are becoming a competitive advantage.

Growing Demand in Aerospace and Automotive Sectors

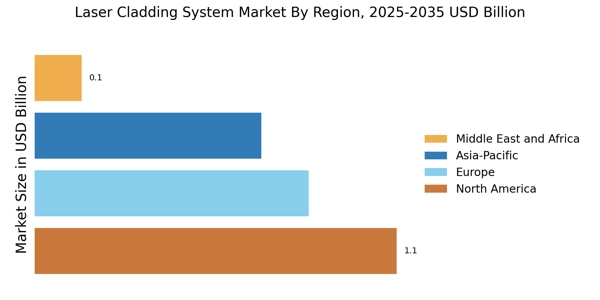

The demand for laser cladding systems is significantly driven by the aerospace and automotive sectors, where the need for durable and lightweight materials is paramount. In the aerospace industry, components such as turbine blades and landing gear require coatings that can withstand extreme conditions, which laser cladding effectively provides. Similarly, the automotive sector is increasingly adopting laser cladding for engine components and wear-resistant parts, as it enhances performance and longevity. The Laser Cladding System Market is expected to benefit from this trend, with projections indicating a market value increase to over 1 billion USD by 2026. This growth is fueled by the ongoing shift towards advanced manufacturing techniques that prioritize efficiency and sustainability, aligning with the industry's goals of reducing emissions and improving fuel efficiency.

Rising Adoption of Additive Manufacturing Techniques

The integration of additive manufacturing techniques within the Laser Cladding System Market is reshaping traditional manufacturing paradigms. Laser cladding is increasingly being utilized as a method for additive manufacturing, allowing for the creation of complex geometries and customized components. This capability is particularly advantageous in industries such as medical devices and tooling, where precision and customization are critical. The market for additive manufacturing is projected to reach 35 billion USD by 2027, with laser cladding playing a pivotal role in this growth. The synergy between laser cladding and additive manufacturing not only enhances product performance but also reduces lead times and costs, making it an attractive option for manufacturers looking to innovate and stay competitive in a rapidly evolving market.