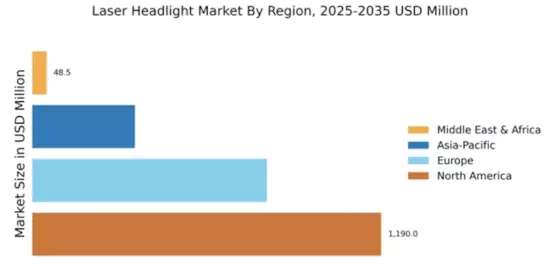

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the laser headlight market, holding a significant market share of 1190.0 million. The region's growth is driven by increasing consumer demand for advanced automotive technologies and stringent safety regulations promoting high-performance lighting solutions. Additionally, the rise in electric vehicle adoption is further propelling the market, as manufacturers seek to enhance vehicle visibility and energy efficiency. The competitive landscape in North America is characterized by the presence of major automotive players such as Ford, General Motors, and Tesla, alongside luxury brands like BMW and Audi. These companies are investing heavily in R&D to innovate and integrate laser headlight technology into their vehicles. The region's robust infrastructure and consumer readiness for high-tech automotive features position it as a key player in the global market.

Europe : Hub for Automotive Excellence

Europe is a pivotal market for laser headlights, with a market size of 800.0 million. The region benefits from a strong automotive industry, characterized by a high demand for innovative lighting solutions that enhance safety and aesthetics. Regulatory frameworks, such as the EU's stringent vehicle safety standards, are driving manufacturers to adopt advanced technologies, including laser headlights, to comply with these regulations and meet consumer expectations. Leading countries like Germany, France, and the UK are at the forefront of this market, hosting key players such as Audi, Mercedes-Benz, and Volkswagen. The competitive landscape is marked by continuous innovation and collaboration among manufacturers to develop cutting-edge lighting technologies. As the market evolves, European companies are focusing on sustainability and energy efficiency, aligning with broader environmental goals.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the laser headlight market, with a market size of 350.0 million. This growth is fueled by rising disposable incomes, increasing vehicle ownership, and a growing preference for premium automotive features. Additionally, government initiatives promoting electric vehicles and advanced safety standards are catalyzing the demand for innovative lighting solutions in the region. Countries like Japan and China are leading the charge, with major automotive manufacturers such as Toyota and Nissan investing in laser headlight technology. The competitive landscape is becoming increasingly dynamic, with both established players and new entrants vying for market share. As consumer awareness of advanced automotive technologies grows, the Asia-Pacific market is expected to expand rapidly, presenting lucrative opportunities for stakeholders.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region represents an emerging market for laser headlights, with a market size of 48.51 million. The growth in this region is driven by increasing urbanization, rising disposable incomes, and a growing automotive sector. As consumers become more aware of advanced lighting technologies, the demand for laser headlights is expected to rise, supported by government initiatives to enhance road safety and vehicle standards. Countries like South Africa and the UAE are leading the market, with a growing number of automotive manufacturers entering the region. The competitive landscape is evolving, with both local and international players seeking to capitalize on the increasing demand for high-quality automotive lighting solutions. As infrastructure improves and consumer preferences shift, the Middle East and Africa are poised for significant growth in the laser headlight market.