Rising Energy Security Concerns

The Latin America Biofuels Market is experiencing a surge in interest due to increasing energy security concerns among nations in the region. Countries are striving to reduce their dependence on imported fossil fuels, which can be volatile in price and availability. This drive towards energy independence is fostering investments in biofuel production, as it is seen as a viable alternative to traditional energy sources. For instance, Brazil, a leader in biofuel production, has set ambitious targets to increase its bioethanol output, aiming for a 20% increase by 2030. This trend is likely to encourage other Latin American countries to explore biofuels as a means to enhance their energy security and stabilize their economies.

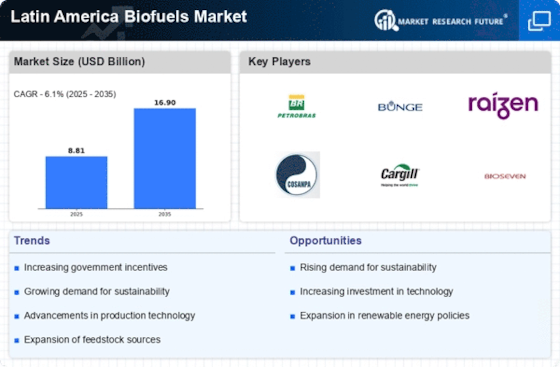

Government Incentives and Subsidies

Government incentives and subsidies are pivotal in driving the Latin America Biofuels Market. Many countries in the region are implementing financial support mechanisms to encourage biofuel production and consumption. For example, Brazil's government has established tax exemptions for bioethanol producers, which has led to a substantial increase in production capacity. Such policies not only stimulate local economies but also promote the use of renewable energy sources. As governments continue to prioritize renewable energy, the biofuels sector is likely to see sustained growth, attracting both domestic and foreign investments.

Growing Transportation Sector Demand

The demand from the transportation sector is a significant driver of the Latin America Biofuels Market. With an increasing focus on reducing carbon emissions from vehicles, biofuels are emerging as a preferred alternative to conventional fuels. Countries like Brazil have already integrated bioethanol into their fuel supply, with over 40% of the market share in the transportation sector. This trend is expected to expand as more nations adopt similar policies to promote cleaner fuels. The rising demand for biofuels in transportation is likely to stimulate further investments in production facilities and infrastructure, thereby enhancing the overall market landscape.

Environmental Sustainability Initiatives

The Latin America Biofuels Market is significantly influenced by the growing emphasis on environmental sustainability. Governments and organizations are increasingly recognizing the need to mitigate climate change impacts, leading to the promotion of biofuels as a cleaner energy source. For example, Argentina has implemented policies to boost biodiesel production, which is expected to reach 3 million tons by 2025. This shift towards sustainable energy sources not only helps in reducing greenhouse gas emissions but also aligns with international climate agreements. The commitment to sustainability is likely to drive further investments in biofuel technologies and infrastructure across the region.

Technological Innovations in Biofuel Production

Technological advancements are playing a crucial role in shaping the Latin America Biofuels Market. Innovations in production processes, such as the development of second and third-generation biofuels, are enhancing efficiency and reducing costs. For instance, the introduction of advanced fermentation techniques and enzyme technologies is expected to increase bioethanol yields significantly. As a result, countries like Brazil and Colombia are likely to benefit from these innovations, potentially increasing their market share in the biofuels sector. The ongoing research and development efforts in biofuel technologies may lead to more sustainable and economically viable production methods, further propelling the industry forward.