Increasing Water Scarcity

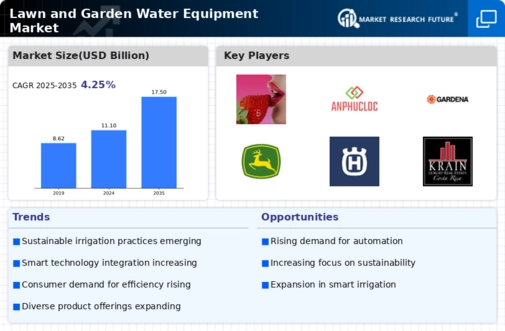

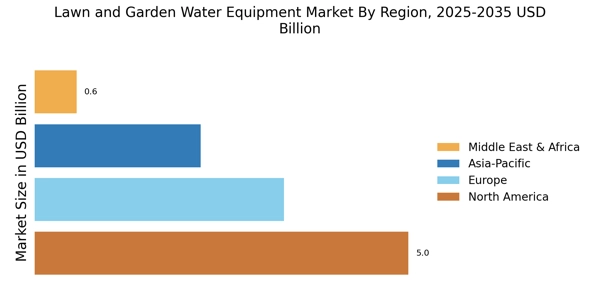

The Lawn and Garden Water Equipment Industry is experiencing a notable shift due to increasing water scarcity in various regions. As water resources become more limited, consumers and businesses are compelled to adopt more efficient watering solutions. This trend is reflected in the rising demand for advanced irrigation systems that optimize water usage. According to recent data, the market for smart irrigation systems is projected to grow significantly, driven by the need for sustainable water management practices. Consequently, manufacturers are focusing on developing innovative products, such as electric lawn mowers, that not only conserve water but also enhance the overall efficiency of lawn and garden maintenance. This growing awareness of water conservation is likely to propel the Lawn and Garden Water Equipment Market forward, as stakeholders seek to address the challenges posed by diminishing water supplies.

Urbanization and Landscaping Trends

Urbanization is significantly impacting the Lawn Garden Water Equipment Market, as more individuals move to urban areas and seek to create green spaces in limited environments. This trend has led to an increased demand for efficient watering solutions that cater to smaller gardens and landscaped areas. As urban dwellers prioritize aesthetics and functionality, the need for specialized lawn and garden equipment is becoming more pronounced. Market data suggests that landscaping services are on the rise, further driving the demand for innovative watering systems. The Lawn and Garden Water Equipment Market is adapting to these changes by offering products that are tailored to urban gardening needs, such as compact irrigation systems and vertical gardening solutions. This evolution reflects a broader trend of integrating nature into urban living, which is likely to sustain growth in the industry.

Rising Consumer Awareness and Education

Consumer awareness and education are increasingly influencing the Lawn Garden Water Equipment industry. As individuals become more informed about the benefits of efficient watering practices and the environmental impact of traditional methods, there is a growing inclination towards adopting modern solutions. Educational initiatives and marketing campaigns are playing a crucial role in disseminating information about the advantages of advanced irrigation systems and water conservation techniques. Market data indicates that consumers are more likely to invest in products that promise efficiency and sustainability. This heightened awareness is fostering a more informed customer base that actively seeks out innovative lawn and garden equipment. As a result, the Lawn and Garden Water Equipment Market is likely to benefit from this trend, as manufacturers respond to the demand for products that align with consumer values and preferences.

Technological Advancements in Equipment

Technological advancements are playing a pivotal role in shaping the Lawn and Garden Water Equipment Market. Innovations such as automated irrigation systems, moisture sensors, and mobile applications for monitoring water usage are becoming increasingly prevalent. These technologies not only improve the efficiency of watering practices but also provide users with real-time data to make informed decisions. The integration of IoT (Internet of Things) in gardening equipment is particularly noteworthy, as it allows for remote management and control of irrigation systems. Market data indicates that the adoption of smart technologies is expected to increase, with a significant portion of consumers showing interest in automated solutions. This trend suggests that the Lawn and Garden Water Equipment Market is on the cusp of a technological revolution, which could redefine traditional gardening practices and enhance user experience.

Growing Interest in Sustainable Gardening

The Lawn Garden Water Equipment Market is witnessing a surge in interest surrounding sustainable gardening practices. As environmental awareness continues to rise, consumers are increasingly seeking products that align with eco-friendly principles. This shift is driving demand for water-efficient irrigation systems and organic gardening solutions. Market Research Future indicates that a substantial percentage of consumers are willing to invest in sustainable products, which is influencing manufacturers to innovate and offer eco-conscious options. The emphasis on sustainability is not only beneficial for the environment but also enhances the appeal of gardening as a hobby. As more individuals adopt sustainable practices, the Lawn and Garden Water Equipment Market is likely to expand, catering to a demographic that prioritizes environmental responsibility in their gardening endeavors.