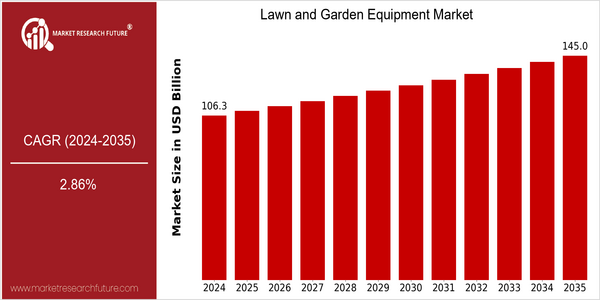

Lawn Garden Equipment Size

Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 106.28 Billion |

| 2035 | USD 145.0 Billion |

| CAGR (2025-2035) | 2.86 % |

Note – Market size depicts the revenue generated over the financial year

The market for garden tools is growing at a good rate, and is expected to reach $ 146 billion by 2035. This growth represents a CAGR of 2.86% between 2025 and 2035. The market is growing due to several factors, such as the growing interest of consumers in gardening and gardening, due to the increased awareness of the environment and the benefits of greenery. Also, technological developments, such as the integration of smart technology in lawn mowers, improve the experience and efficiency of the end users, thus boosting market growth. The main players in the garden tools market, such as Husqvarna, John Deere and Toro, are investing in the development of new products and strategic alliances to gain a larger market share. Husqvarna, for example, has developed robot mowers to meet the increasing demand for automation in gardening. John Deere, on the other hand, with its focus on precision agriculture and its commitment to the environment, has been able to position itself well in a market where the green consciousness of consumers is growing. The above strategic initiatives illustrate the dynamic nature of the garden tools market, as companies adapt to the changing preferences and technological developments of consumers.

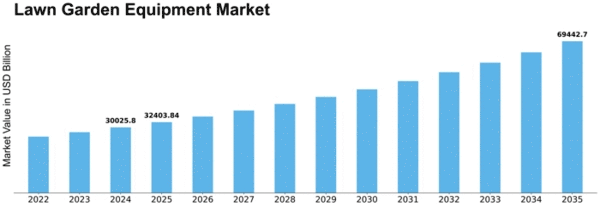

Regional Market Size

Regional Deep Dive

The Garden and Lawn Equipment Market is experiencing a dynamic growth in the regions of the world, mainly due to the increasing interest of consumers in outdoor living, the sustainable development and the technological progress. In North America, the market is characterized by a strong self-help culture and a growing tendency towards electric and battery-powered equipment. In Europe, the focus is on eco-friendly products. The Asian-Pacific region is booming with the increasing urbanization and the rising incomes. The Middle East and Africa are investing in gardening and landscaping as the cities develop. In Latin America, the agricultural machinery, which is used both in commercial and in private gardens, is the main focus.

Europe

- The European Union's Green Deal is promoting sustainable practices, leading to a surge in demand for electric lawn and garden equipment, with companies like Stiga and Bosch innovating in this space.

- In the UK, the recent ban on petrol-powered garden equipment is driving consumers towards battery-operated alternatives, significantly impacting purchasing decisions and market dynamics.

Asia Pacific

- Rapid urbanization in countries like China and India is leading to increased demand for compact and efficient lawn and garden equipment, with local manufacturers like STIHL and Honda expanding their product lines.

- Government initiatives promoting urban greening and landscaping projects are creating new opportunities for market growth, particularly in metropolitan areas.

Latin America

- The growing trend of urban gardening in cities like São Paulo and Buenos Aires is driving demand for compact gardening tools and equipment, with local startups emerging to meet this need.

- Government programs aimed at promoting agricultural efficiency are encouraging the adoption of modern lawn and garden equipment, particularly in rural areas.

North America

- The rise of smart gardening technologies, such as IoT-enabled lawn mowers and automated irrigation systems, is transforming the market landscape, with companies like Husqvarna leading the charge.

- Regulatory changes in California aimed at reducing water usage are pushing consumers towards more efficient lawn care solutions, thereby increasing demand for drought-resistant landscaping equipment.

Middle East And Africa

- The UAE's Vision 2021 initiative is encouraging investment in green spaces and landscaping, leading to increased demand for lawn and garden equipment in urban developments.

- Sustainable gardening practices are gaining traction, with organizations like the African Green Revolution Forum promoting eco-friendly gardening solutions to combat desertification.

Did You Know?

“Did you know that the global lawn and garden equipment market is expected to see a significant shift towards electric and battery-operated tools, with projections indicating that these products could account for over 50% of the market by 2025?” — Market Research Future

Segmental Market Size

During the last few years, the garden and lawn equipment market has grown steadily, driven by an increased interest in the garden and lawn aesthetics and the sustainable gardening of the lawn. Post-pandemic, the trend towards gardening in private households is expected to increase. And meanwhile, the growing interest in electric tools and batteries, which are more environmentally friendly, also contributes to the growing interest in the market. At the present time, the market is in a mature phase of development, where companies such as Husqvarna and Toro lead in the development of new products, such as robot mowers and smart watering systems. The main applications are private gardens, commercial gardens and urban gardening. The main trends driving growth are sustainable development and the government's encouragement of eco-friendly practices. The evolution of the market is characterized by the use of IoT-enabled devices and AI-based analysis, which lead to more efficient resource management and better customer experiences.

Future Outlook

From 2024 to 2035, the market for lawn and garden equipment will grow steadily, from $105 billion to $145 billion, at a compound annual growth rate of 2.86%. This growth is based on a growing interest in outdoor living and the growing trend towards sustainable gardening. As urbanization continues, more and more households are buying lawn and garden equipment to beautify their outside areas, which will lead to a higher penetration of the market, so that about 60% of households will have some kind of lawn and garden equipment by 2035, up from 50% in 2024. Also, major technological innovations, such as the integration of smart technology and automation into lawn and garden equipment, will continue to drive the market. The market for robot lawn mowers and Internet of Things-enabled garden tools is growing steadily, as they appeal to tech-savvy consumers who value convenience and efficiency. Moreover, government policies promoting sustainable practices and the use of eco-friendly products will stimulate the market. As consumers become more concerned with the environment, the market will be dominated by electric and battery-powered equipment, which will account for more than 30% of total sales by 2035. Consequently, the lawn and garden equipment market is set to change significantly, driven by changes in consumer preferences, technological innovations and government support.

Leave a Comment