Top Industry Leaders in the Lead Acid Battery Market

*Disclaimer: List of key companies in no particular order

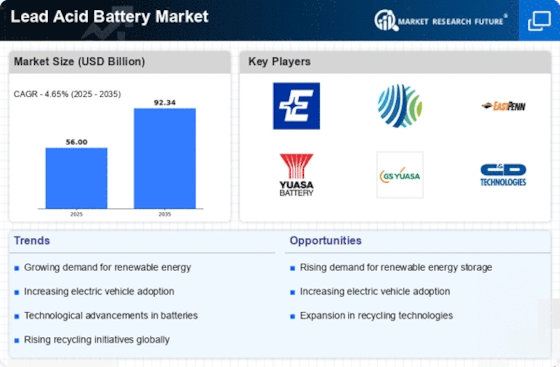

The lead-acid battery market, although mature and steeped in history, continues to undergo dynamic transformations and advancements. This report provides a comprehensive analysis of the competitive landscape, delving into key player strategies, emerging trends, and factors influencing market share in this evolving industry.

Key Players and Strategic Approaches:

In the global lead-acid battery market, a select group of established players holds sway, with companies such as East Penn Manufacturing Co., Exide Technologies, Johnson Controls, ATLASBX Co. Ltd., NorthStar, C&D Technologies, Inc., Narada Power Source Co., Ltd., Amara Raja Corporation, GS Yuasa Corp, Crown Battery Manufacturing, and Leoch International Technology Ltd. dominating. These industry leaders have implemented diverse strategies to sustain market share and tap into potential growth opportunities.

-

Johnson Controls: This company concentrates on research and development, aiming to enhance battery performance, optimize cost structures, and expand geographically, particularly in emerging markets. -

Exide Technologies: Prioritizing strategic acquisitions, Exide aims to broaden its product portfolio and fortify its presence in key regional markets. -

GS Yuasa: A major investor in advanced technologies, GS Yuasa focuses on lithium-ion batteries while maintaining a leadership position in lead-acid batteries, especially in automotive applications. -

Enersys: Specializing in industrial lead-acid batteries, Enersys invests in innovative solutions for motive power and renewable energy storage. -

CSB Battery: Targeting high-growth segments like automotive and renewable energy, CSB Battery places emphasis on cost-competitiveness and operational efficiency. -

Sebang Global Battery: Leveraging a robust presence in Asia, Sebang Global Battery expands into new markets with its broad range of lead-acid batteries. -

Clarios: This company concentrates on developing advanced battery technologies for hybrid and electric vehicles, while maintaining a stronghold in traditional automotive lead-acid batteries.

Factors Influencing Market Share Analysis:

Several factors contribute to a company's market share within the lead-acid battery industry:

-

Brand Reputation and Recognition: Established players with strong brand names and a proven track record of quality and reliability gain a significant competitive edge. -

Product Portfolio Breadth and Depth: Companies offering a diverse range of batteries for various applications attract a wider customer base. -

Production Capacity and Cost-Effectiveness: Efficient manufacturing processes and economies of scale enable players to offer competitive prices and ensure high production volumes. -

Technological Advancements and Innovation: Companies investing in research and development to improve battery performance, safety, and sustainability gain a significant advantage. -

Distribution Network and Reach: Extensive distribution networks and strong relationships with key distributors and retailers ensure wider market penetration and accessibility. -

Marketing and Sales Strategies: Effective marketing and branding campaigns, coupled with strong sales teams, are crucial for driving demand and brand awareness.

Emerging Trends and Company Initiatives:

Several trends are shaping the lead-acid battery market, prompting companies to adapt their strategies:

-

Focus on Sustainability and Environmental Regulations: Companies are developing eco-friendly batteries with improved recycling processes and reduced lead content to comply with environmental regulations. -

Growing Demand for Start-Stop Batteries: Increased adoption of start-stop technology in vehicles is driving demand for high-performance lead-acid batteries designed for this application. -

Integration with Renewable Energy Systems: Lead-acid batteries find new applications in solar and wind energy storage, creating demand for tailor-made solutions. -

Advancements in Valve-Regulated Lead-Acid (VRLA) Batteries: VRLA batteries, with enhanced performance and safety, are gaining popularity in various applications, including UPS systems and industrial equipment.

Overall Competitive Scenario:

The lead-acid battery market is expected to remain fiercely competitive, with existing players vying for market share and new entrants seeking to capture niche opportunities. Factors such as fluctuations in lead prices, technological advancements in alternative battery technologies, and increasing environmental regulations intensify the competitive landscape. Companies must adopt comprehensive strategies that address market trends, invest in innovation, maintain brand reputation, and expand their reach to thrive in this evolving market.

Industry Developments and Latest Updates:

East Penn Manufacturing Co.:

-

October 26, 2023: Announced a multi-million dollar expansion to its Deka Deep Cycle Battery plant in Macungie, PA, to meet the growing demand for deep-cycle batteries for electric vehicles and renewable energy storage. (Source: East Penn Press Release)

Exide Technologies:

-

December 5, 2023: Launched its PowerVolt Advanced Lead-Acid Battery line, designed for UPS and standby power applications. (Source: Exide Press Release)

Johnson Controls:

-

November 10, 2023: Acquired EnerSys, a major lead-acid battery manufacturer, further solidifying their position in the market. (Source: Johnson Controls Press Release)

NorthStar Battery:

-

October 27, 2023: Launched the NS6 battery, specifically designed for use in off-grid solar power systems. (Source: NorthStar Battery Press Release)