Market Analysis

In-depth Analysis of Lecithin Market Industry Landscape

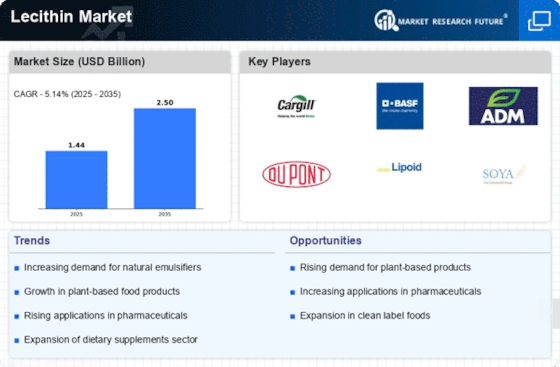

The market dynamics of lecithin, a natural emulsifier derived from various sources such as soybeans, sunflower, and eggs, are influenced by a combination of factors that collectively shape its landscape. Lecithin finds widespread applications across diverse industries, including food and beverages, pharmaceuticals, cosmetics, and animal feed. One key driver of the market is the increasing demand for natural and plant-based ingredients in the food industry. Lecithin, known for its emulsifying and stabilizing properties, is used to improve texture and shelf life in a variety of food products. As consumer preferences gravitate towards clean label and natural ingredients, the market dynamics of lecithin respond to the growing demand for this versatile emulsifier.

The pharmaceutical industry significantly contributes to the market dynamics of lecithin, utilizing it as an excipient in drug formulations. Lecithin's role in enhancing the solubility and bioavailability of active pharmaceutical ingredients has led to increased adoption in the pharmaceutical sector. As the pharmaceutical industry continues to advance, the demand for lecithin in drug delivery systems and formulations is expected to drive market growth.

Cosmetic and personal care products also play a pivotal role in shaping the market dynamics of lecithin. Lecithin is valued for its moisturizing and emulsifying properties in skincare and haircare products. The demand for natural and skin-friendly ingredients has led to the incorporation of lecithin in various cosmetic formulations, contributing to the expansion of its market dynamics within the beauty and personal care industry.

The animal nutrition sector is another significant contributor to the market dynamics of lecithin. In animal feed formulations, lecithin serves as an essential component, contributing to improved digestion and nutrient absorption. The demand for high-quality and nutritionally enhanced animal feed has propelled the utilization of lecithin, influencing market dynamics within the agriculture and animal husbandry sectors.

Global trade and international market dynamics also impact the lecithin market, as the sourcing and availability of raw materials from different regions influence pricing and supply chains. Fluctuations in commodity markets, geopolitical factors, and trade agreements contribute to the overall market dynamics, requiring industry stakeholders to navigate and adapt to changing global conditions.

Technological advancements in lecithin extraction processes and product development contribute to the evolving market dynamics. Innovative methods for producing lecithin with improved purity and functionality, as well as the development of lecithin derivatives, open up new possibilities for applications in various industries. These advancements contribute to market growth by expanding the range of lecithin-based products and improving their performance in different formulations.

Challenges within the market dynamics of lecithin include sustainability considerations, as the soybean industry, a major source of lecithin, faces scrutiny regarding deforestation and environmental impact. Industry participants are increasingly focusing on sustainable sourcing practices and certifications to address these concerns, influencing market dynamics by promoting eco-friendly initiatives.

Leave a Comment