Market Trends

Key Emerging Trends in the Lecithin Market

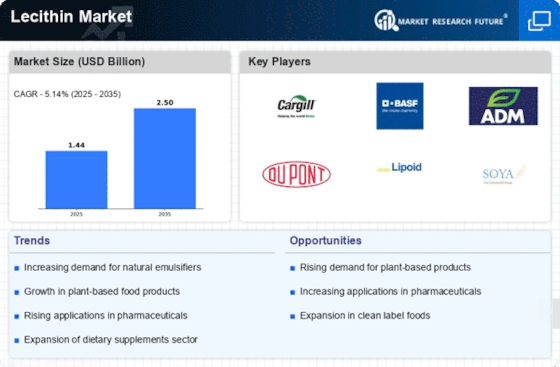

The lecithin market is undergoing significant trends, reflecting the versatile applications of lecithin in various industries such as food and beverages, pharmaceuticals, cosmetics, and agriculture. Lecithin, a natural emulsifier derived from soybeans, sunflower, or other sources, plays a crucial role in improving texture, stability, and shelf life in a wide range of products. One prevalent trend in the lecithin market is the increasing demand for clean-label and natural ingredients in food and beverages. Consumers are becoming more conscious of their dietary choices, leading manufacturers to incorporate lecithin as a natural and recognizable ingredient in products such as baked goods, chocolates, and beverages. This trend aligns with the broader movement towards cleaner and transparent labeling, emphasizing the natural origins of ingredients.

Moreover, the pharmaceutical industry is witnessing a surge in the use of lecithin as an excipient in drug formulations. Lecithin's emulsifying and solubilizing properties make it a valuable component in pharmaceutical formulations, enhancing the bioavailability of poorly soluble drugs. As the pharmaceutical sector continues to focus on drug delivery systems and formulations, lecithin's role in improving drug solubility and efficacy is contributing to its increasing adoption.

Additionally, the cosmetics and personal care industry is experiencing a growing interest in lecithin for its skin-conditioning properties. Lecithin acts as a natural emollient, providing moisturization and promoting skin health. Skincare and cosmetic products incorporating lecithin are gaining popularity as consumers seek products that not only enhance aesthetics but also offer skincare benefits. This trend aligns with the rising demand for natural and multifunctional ingredients in the cosmetics industry.

Furthermore, the lecithin market is witnessing innovation in terms of product development and extraction methods. The exploration of alternative sources, such as sunflower lecithin, is gaining traction, offering a non-GMO and allergen-free alternative to soy-based lecithin. Additionally, advancements in extraction technologies, including cold-pressed and enzymatic methods, are contributing to the production of high-quality lecithin with improved functionality. The market's commitment to innovation is addressing consumer preferences for sustainable, allergen-free, and technologically advanced lecithin products.

Sustainability is becoming a significant trend in the lecithin market, with consumers and manufacturers alike recognizing the importance of environmentally friendly practices. Brands are increasingly focusing on sustainable sourcing of raw materials, supporting responsible agricultural practices, and adopting eco-friendly production processes. This sustainability trend is reshaping the supply chain of lecithin, influencing sourcing decisions and encouraging transparent and ethical business practices.

Moreover, the globalized nature of the food industry is influencing the lecithin market, with increased international trade and collaborations. Manufacturers are expanding their presence in various regions, and the accessibility of lecithin as a global ingredient is growing. This globalization trend is creating opportunities for market players to cater to diverse regional preferences and expand their product portfolios.

Leave a Comment