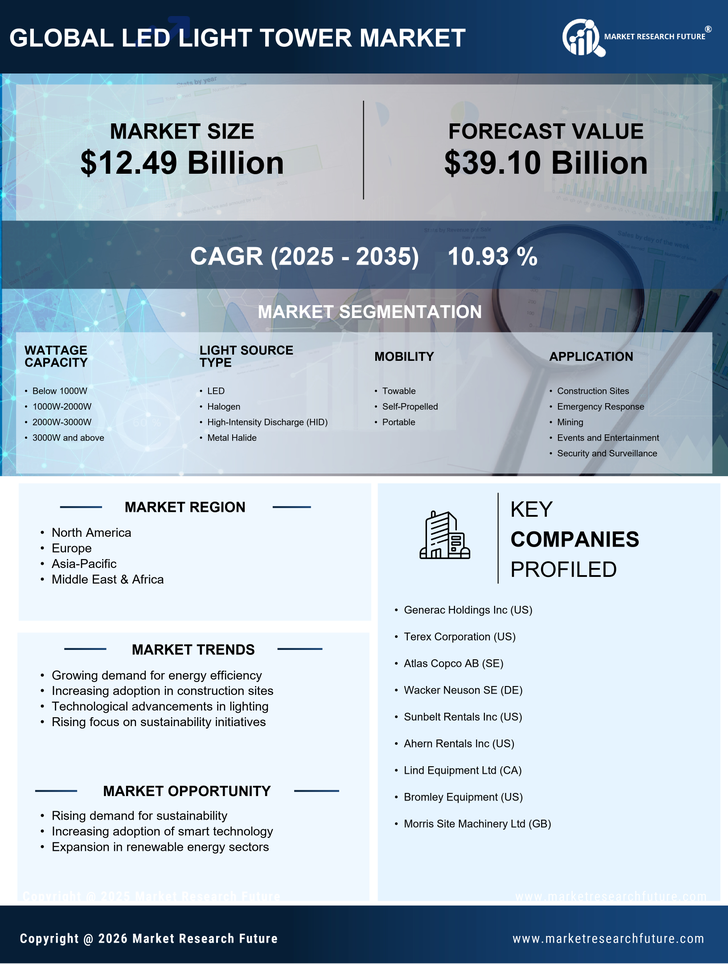

Rising Demand for Energy Efficiency

The LED Light Tower Market experiences a notable surge in demand for energy-efficient lighting solutions. As organizations increasingly prioritize sustainability, the shift towards LED technology becomes more pronounced. LED light towers consume significantly less energy compared to traditional lighting systems, which aligns with global efforts to reduce carbon footprints. Reports indicate that LED lighting can reduce energy consumption by up to 75%, making it an attractive option for various applications. This trend is further supported by government incentives aimed at promoting energy-efficient technologies. Consequently, the growing emphasis on energy conservation is likely to drive the LED Light Tower Market forward, as businesses seek to lower operational costs while adhering to environmental regulations.

Government Regulations and Incentives

The LED Light Tower Market is shaped by government regulations and incentives aimed at promoting energy-efficient technologies. Many governments are implementing stricter regulations on energy consumption and emissions, encouraging businesses to adopt LED lighting solutions. Incentives such as tax credits and rebates for energy-efficient upgrades further stimulate the market. These policies not only support environmental goals but also provide financial benefits to organizations that transition to LED technology. As compliance with these regulations becomes increasingly important, the demand for LED light towers is expected to rise. This regulatory environment is likely to create a favorable landscape for the LED Light Tower Market, fostering growth and innovation.

Technological Innovations in Lighting Solutions

The LED Light Tower Market is significantly influenced by ongoing technological innovations in lighting solutions. Advancements in LED technology, such as improved lumens per watt and enhanced durability, contribute to the growing appeal of LED light towers. These innovations not only improve energy efficiency but also extend the lifespan of lighting equipment, reducing maintenance costs for users. Furthermore, the integration of smart technology, such as remote monitoring and control systems, enhances the functionality of LED light towers. As these technologies become more accessible, the market is likely to witness increased adoption of LED light towers across various sectors, including construction, emergency services, and outdoor events, thereby driving the LED Light Tower Market.

Increased Focus on Outdoor Events and Activities

The LED Light Tower Market benefits from the rising popularity of outdoor events and activities. Festivals, concerts, and sporting events require effective lighting solutions to ensure visibility and safety for attendees. LED light towers offer portability and high-intensity illumination, making them ideal for such applications. The market for outdoor events is projected to grow significantly, with estimates suggesting an increase in attendance and frequency of events. This trend indicates a growing reliance on LED light towers to provide adequate lighting in various outdoor settings. As event organizers prioritize safety and visibility, the demand for LED light towers is likely to rise, thereby enhancing the LED Light Tower Market.

Expansion of Construction and Infrastructure Projects

The LED Light Tower Market is poised for growth due to the expansion of construction and infrastructure projects. As urbanization accelerates, the need for effective lighting solutions in construction sites becomes critical. LED light towers provide reliable illumination, enhancing safety and productivity during nighttime operations. According to industry reports, the construction sector is projected to grow at a compound annual growth rate of over 5% in the coming years. This growth is likely to increase the demand for LED light towers, as contractors and project managers seek efficient lighting solutions that can withstand harsh conditions. The integration of LED technology in construction lighting is expected to become a standard practice, further propelling the LED Light Tower Market.