Rise of Remote Work

The rise of remote work has significantly influenced the Legal Billing Software Market. As legal professionals adapt to flexible work environments, the need for accessible and efficient billing solutions has surged. Legal billing software that supports remote access allows attorneys to manage their billing processes from anywhere, enhancing productivity and collaboration. Data indicates that firms utilizing cloud-based legal billing solutions have seen a 25% increase in billable hours. This shift towards remote work is likely to sustain the growth of the Legal Billing Software Market as firms seek to accommodate evolving work dynamics.

Growing Demand for Efficiency

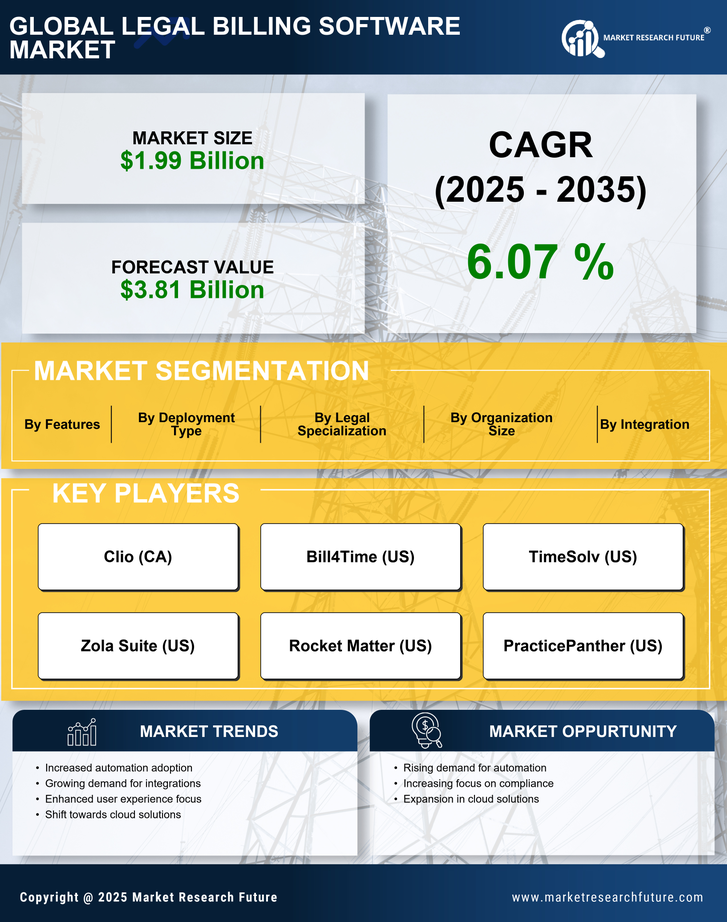

The Legal Billing Software Market experiences a growing demand for efficiency as law firms and legal departments seek to streamline their billing processes. This demand is driven by the need to reduce administrative overhead and improve cash flow. According to recent data, firms that implement legal billing software can reduce billing cycle times by up to 30%. This efficiency not only enhances client satisfaction but also allows legal professionals to focus more on their core competencies. As competition intensifies, the pressure to adopt efficient billing solutions becomes paramount, indicating a robust growth trajectory for the Legal Billing Software Market.

Regulatory Compliance Requirements

Regulatory compliance remains a critical driver in the Legal Billing Software Market. Legal firms are increasingly required to adhere to stringent billing regulations and standards, which necessitates the adoption of specialized software solutions. Non-compliance can lead to severe penalties and reputational damage, prompting firms to invest in legal billing software that ensures adherence to these regulations. The market is projected to grow as firms recognize the importance of compliance in maintaining their operational integrity. This trend suggests that the Legal Billing Software Market will continue to expand as more firms prioritize compliance-driven solutions.

Client Expectations for Transparency

Client expectations for transparency in billing practices are reshaping the Legal Billing Software Market. Clients increasingly demand detailed invoices and clear breakdowns of legal fees, which necessitates the use of sophisticated billing software. Legal billing solutions that provide transparency not only enhance client trust but also improve the overall client experience. Firms that adopt such software can expect to see a rise in client retention rates. This trend indicates that the Legal Billing Software Market will continue to thrive as firms strive to meet the evolving expectations of their clients.

Technological Advancements in Billing Solutions

Technological advancements are a driving force in the Legal Billing Software Market. Innovations such as artificial intelligence and machine learning are being integrated into billing solutions, enabling firms to automate time tracking and invoice generation. These advancements not only reduce human error but also enhance the accuracy of billing processes. The market is witnessing a shift towards more intelligent billing systems that can analyze billing patterns and provide insights for better decision-making. This trend suggests a promising future for the Legal Billing Software Market as technology continues to evolve and reshape billing practices.