Patient-Centric Solutions

The Life Sciences Software Market is increasingly focusing on patient-centric solutions that enhance patient engagement and improve health outcomes. Software applications that facilitate patient monitoring, telehealth services, and personalized medicine are gaining popularity. The market for patient engagement software is projected to grow significantly, driven by the rising demand for solutions that empower patients to take an active role in their healthcare. These tools enable healthcare providers to collect real-time patient data, leading to more tailored treatment plans and improved patient satisfaction. This trend suggests that the Life Sciences Software Market is shifting towards a more patient-focused approach, which may ultimately lead to better health outcomes and increased efficiency in healthcare delivery.

Data Management and Analytics

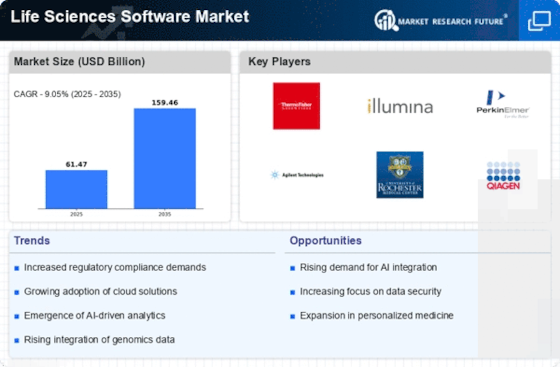

In the Life Sciences Software Market, the increasing volume of data generated from research and clinical trials necessitates robust data management and analytics solutions. The market for data analytics software is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% through 2025. This growth is driven by the need for life sciences organizations to derive actionable insights from vast datasets, enabling them to make informed decisions and accelerate drug development processes. Advanced analytics tools facilitate real-time data analysis, enhancing the ability to monitor clinical trial progress and patient outcomes. Consequently, the Life Sciences Software Market is witnessing a shift towards integrated data management platforms that streamline data collection, storage, and analysis, thereby improving overall research efficiency.

Integration of Advanced Technologies

The Life Sciences Software Market is witnessing a notable shift towards the integration of advanced technologies, such as machine learning and blockchain. These technologies are being adopted to enhance data security, streamline processes, and improve decision-making capabilities. For instance, machine learning algorithms are increasingly utilized for predictive analytics in drug discovery, while blockchain technology is being explored for secure data sharing and traceability in clinical trials. The market for software solutions incorporating these technologies is expected to expand, as organizations seek to leverage innovative tools to gain a competitive edge. This trend indicates that the Life Sciences Software Market is evolving to embrace technological advancements, which could potentially transform traditional practices and enhance operational efficiencies.

Collaboration and Communication Tools

The Life Sciences Software Market is increasingly influenced by the demand for enhanced collaboration and communication tools. As research and development activities become more complex, the need for seamless communication among multidisciplinary teams is paramount. Software solutions that facilitate real-time collaboration, such as project management and communication platforms, are gaining traction. The market for collaboration software in life sciences is projected to grow, driven by the need for efficient information sharing and project tracking. These tools enable researchers, clinicians, and regulatory professionals to work together more effectively, thereby expediting the development of new therapies. This trend suggests that the Life Sciences Software Market is adapting to the collaborative nature of modern research, ultimately leading to improved outcomes and faster time-to-market for new products.

Regulatory Compliance and Quality Assurance

The Life Sciences Software Market is increasingly driven by the need for stringent regulatory compliance and quality assurance. Regulatory bodies, such as the FDA and EMA, impose rigorous standards on life sciences companies, necessitating the adoption of software solutions that ensure compliance with Good Manufacturing Practices (GMP) and Good Clinical Practices (GCP). As of 2025, the market for compliance management software is projected to reach approximately 2 billion USD, reflecting a growing emphasis on maintaining high-quality standards. Companies are investing in software that automates compliance processes, thereby reducing the risk of non-compliance and enhancing operational efficiency. This trend indicates that the Life Sciences Software Market is evolving to meet the demands of regulatory frameworks, ultimately fostering innovation and improving patient safety.