Increasing Demand for E-Commerce

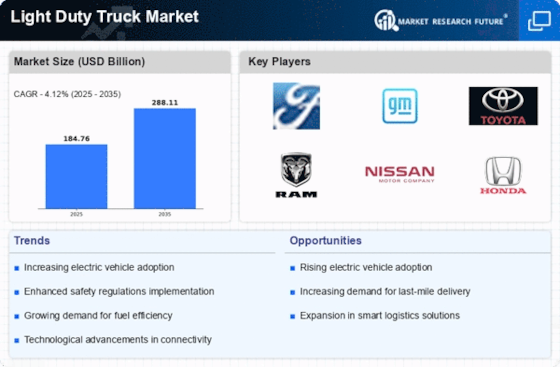

The rise of e-commerce has led to a notable increase in demand for light duty trucks, as businesses require efficient logistics solutions to meet consumer expectations. The Light Duty Truck Market is experiencing a surge in sales, driven by the need for last-mile delivery vehicles. In 2025, it is estimated that e-commerce sales will account for a significant portion of retail sales, necessitating a robust fleet of light duty trucks. This trend indicates that companies are investing in their transportation capabilities to ensure timely deliveries, thereby propelling the growth of the light duty truck market. Furthermore, the shift towards online shopping has prompted logistics companies to upgrade their fleets, favoring light duty trucks for their versatility and fuel efficiency. As a result, the light duty truck market is poised for continued expansion in response to the evolving landscape of consumer purchasing behavior.

Government Regulations and Incentives

Government regulations aimed at reducing emissions and promoting fuel efficiency are influencing the light duty truck market. The Light Duty Truck Market is adapting to stricter environmental standards, which are becoming increasingly prevalent across various regions. In 2025, many countries are expected to implement incentives for manufacturers and consumers to adopt cleaner technologies. This includes tax breaks for electric and hybrid light duty trucks, which could potentially enhance their market appeal. As manufacturers innovate to comply with these regulations, the market may witness a shift towards more sustainable options. The introduction of low-emission zones in urban areas further encourages the adoption of light duty trucks that meet stringent environmental criteria. Consequently, these regulatory frameworks are likely to drive growth in the light duty truck market, as stakeholders seek to align with governmental objectives.

Technological Innovations in Vehicle Design

Technological advancements in vehicle design are reshaping the light duty truck market. The Light Duty Truck Market is witnessing a wave of innovations, including enhanced safety features, improved fuel efficiency, and advanced connectivity options. In 2025, the integration of smart technologies such as telematics and autonomous driving capabilities is expected to become more prevalent. These innovations not only enhance the driving experience but also improve operational efficiency for businesses relying on light duty trucks. The adoption of lightweight materials and aerodynamic designs is likely to contribute to better fuel economy, which is a critical factor for fleet operators. As manufacturers continue to invest in research and development, the light duty truck market is anticipated to evolve, offering consumers a wider array of technologically advanced options that cater to their diverse needs.

Urbanization and Infrastructure Development

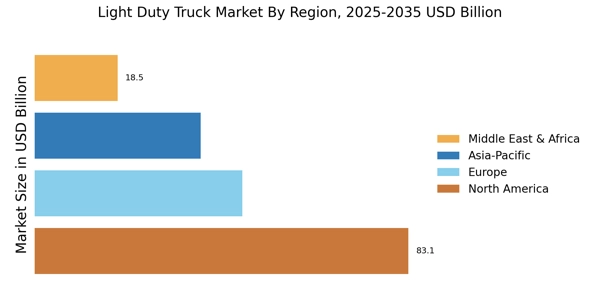

Urbanization trends are significantly impacting the light duty truck market. The Light Duty Truck Market is responding to the increasing demand for transportation solutions in densely populated areas. As urban centers expand, the need for efficient delivery systems becomes paramount. In 2025, infrastructure development projects are expected to create new opportunities for light duty trucks, particularly in urban logistics. The rise of smart cities and improved road networks may facilitate smoother operations for light duty truck fleets. Additionally, the growing emphasis on sustainable urban transport solutions is likely to drive the adoption of light duty trucks that are designed for urban environments. This trend suggests that as cities evolve, the light duty truck market will adapt to meet the unique challenges and requirements of urban logistics.

Shifting Consumer Preferences Towards Sustainability

Consumer preferences are increasingly leaning towards sustainability, influencing the light duty truck market. The Light Duty Truck Market is witnessing a shift as buyers prioritize environmentally friendly options. In 2025, consumers are expected to favor light duty trucks that offer lower emissions and better fuel efficiency. This trend is prompting manufacturers to develop more sustainable models, including electric and hybrid vehicles. The growing awareness of climate change and its impact on purchasing decisions indicates that sustainability is becoming a key factor in the light duty truck market. As a result, companies are likely to enhance their product offerings to align with consumer expectations. This shift in preferences may not only drive sales but also encourage innovation within the industry, as manufacturers strive to meet the demand for greener transportation solutions.