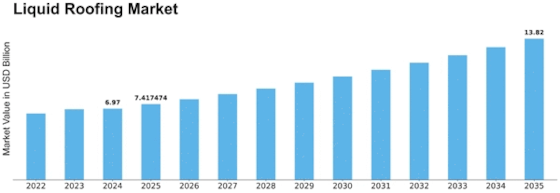

Liquid Roofing Size

Liquid Roofing Market Growth Projections and Opportunities

The Liquid Roofing market experiences the influence of various factors that collectively shape its dynamics. Understanding these elements is crucial for industry participants to make informed decisions and navigate the market effectively.

Construction Industry Growth:

The primary driver for liquid roofing is the construction industry, where these materials are widely used for waterproofing and protecting building structures. The overall health and growth of the construction sector, including residential, commercial, and industrial projects, significantly impact the demand for liquid roofing. Renovation and Maintenance Projects:

Liquid roofing is commonly employed in renovation and maintenance projects to extend the lifespan of existing roofs. The demand for liquid roofing materials is influenced by the frequency of renovation activities and the need for cost-effective solutions to enhance roof durability. Sustainability and Green Building Practices:

Increasing emphasis on sustainability and green building practices has led to a rise in demand for environmentally friendly roofing solutions. Liquid roofing materials, often formulated with eco-friendly components, align with these trends, impacting market dynamics as consumers prioritize sustainable options. Urbanization and Population Growth:

Urbanization trends and population growth drive the need for new construction projects and the renovation of existing structures. Liquid roofing, as a versatile and durable solution, sees increased demand in urban areas experiencing expansion and development. Climate and Weather Conditions:

The climatic and weather conditions of a region influence the choice of roofing materials, with liquid roofing being particularly suitable for areas prone to extreme weather events. Regions experiencing heavy rainfall, temperature variations, or intense sunlight contribute to the market demand for liquid roofing solutions. Technological Advancements:

Ongoing technological advancements in liquid roofing formulations and application methods impact market dynamics. Companies investing in research and development to improve the performance, ease of application, and longevity of liquid roofing materials gain a competitive edge. Regulatory Compliance:

Stringent building codes and regulations related to roofing materials influence the adoption of liquid roofing solutions. Compliance with industry standards and regulations is crucial for manufacturers and contractors to ensure the safety and quality of roofing installations. Ease of Application and Installation:

Liquid roofing offers advantages in terms of ease of application, especially for complex roof structures. The simplicity and efficiency of installation impact market dynamics as contractors and builders seek convenient and time-saving solutions. Building Design Trends:

Architectural trends and design preferences influence the choice of roofing materials. Liquid roofing, with its ability to conform to various shapes and designs, is favored in modern architecture, impacting market dynamics as design trends evolve. Cost Considerations:

The cost-effectiveness of liquid roofing solutions compared to traditional roofing materials influences market dynamics, especially in budget-conscious construction projects. Companies offering competitive pricing and cost-efficient solutions are better positioned to capture market share. Competitive Landscape:

Intense competition among liquid roofing manufacturers and suppliers drives innovations in product formulations, quality, and pricing. Companies that focus on differentiation, customer service, and marketing strategies enhance their competitiveness in a crowded market. Resilience and Durability Requirements:

The need for resilient and durable roofing solutions to withstand environmental factors and ensure long-term performance is a key market factor. Liquid roofing, known for its durability and ability to withstand harsh conditions, is favored in regions with demanding weather patterns.

Leave a Comment