Liquid Soap Market Summary

As per Market Research Future analysis, The Global Liquid Soap Market Size was estimated at 23.49 USD Billion in 2024. The liquid soap industry is projected to grow from 25.21 USD Billion in 2025 to 51.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Liquid Soap Market is experiencing a dynamic shift towards sustainability and health-conscious products.

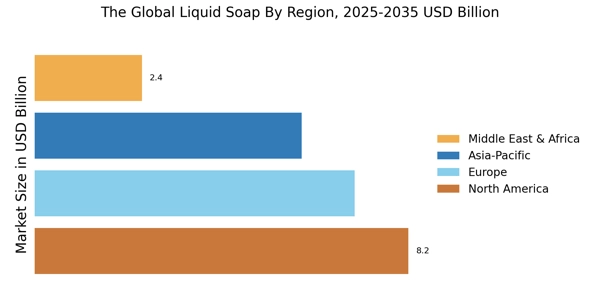

- North America remains the largest market for liquid soap, driven by increasing consumer awareness of hygiene and sustainability.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rising disposable incomes and urbanization.

- Bath and body soaps dominate the market, while dish wash soaps are witnessing the fastest growth due to changing consumer preferences.

- Key market drivers include a strong focus on sustainability and health and wellness trends, which are shaping product development and consumer choices.

Market Size & Forecast

| 2024 Market Size | 23.49 (USD Billion) |

| 2035 Market Size | 51.0 (USD Billion) |

| CAGR (2025 - 2035) | 7.3% |

Major Players

Procter & Gamble (US), Unilever (GB), Colgate-Palmolive (US), Reckitt Benckiser (GB), Henkel (DE), SC Johnson (US), Caldrea (US), Ecover (BE), Seventh Generation (US), Method Products (US)