Expansion in the Automotive Sector

The Liquid Sodium Silicate Market is poised for growth due to the expanding automotive sector. Liquid sodium silicate is utilized in various applications, including as a sealant and adhesive in automotive manufacturing. The automotive industry has been witnessing a resurgence, with production levels expected to rise significantly in the coming years. This growth is likely to drive the demand for liquid sodium silicate, as manufacturers seek materials that offer durability and performance. Additionally, the increasing focus on lightweight materials in vehicle production may further enhance the appeal of liquid sodium silicate, as it provides a strong yet lightweight solution for various automotive applications.

Innovations in Industrial Applications

The Liquid Sodium Silicate Market is witnessing innovations that are expanding its applications across various industrial sectors. Industries such as paper, textiles, and ceramics are increasingly adopting liquid sodium silicate for its binding and adhesive properties. The versatility of liquid sodium silicate allows it to be utilized in diverse processes, enhancing product quality and performance. As industries continue to innovate and seek efficient solutions, the demand for liquid sodium silicate is likely to grow. Furthermore, advancements in production techniques may lead to cost reductions, making liquid sodium silicate more accessible to a broader range of industries, thus driving market growth.

Increasing Demand from Detergent Industry

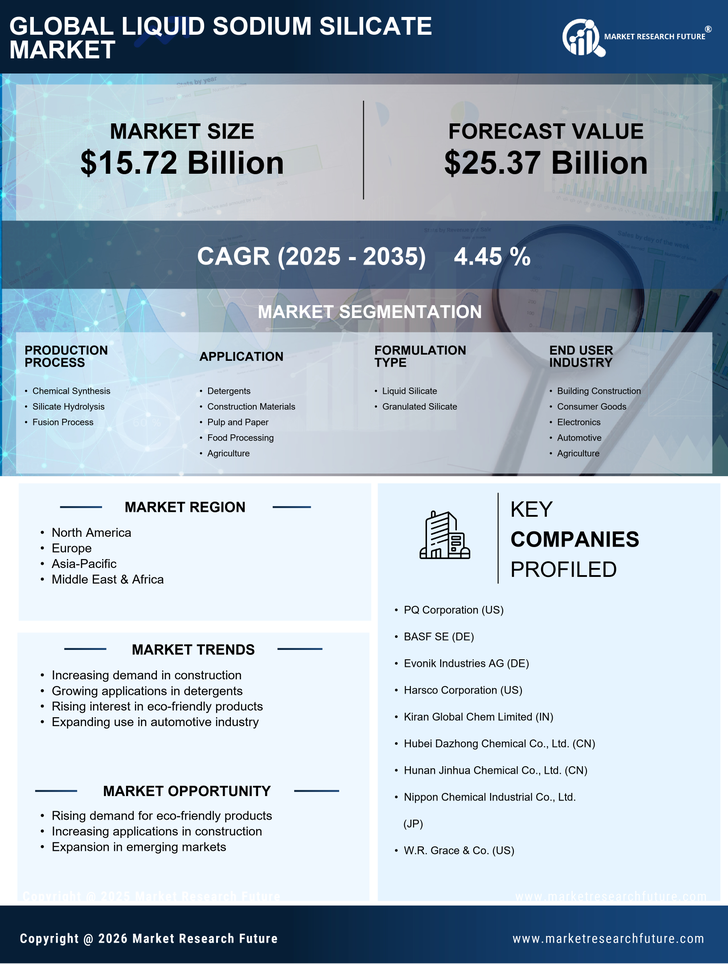

The Liquid Sodium Silicate Market is experiencing a notable surge in demand from the detergent sector. This is primarily due to the compound's effectiveness as a builder in laundry detergents, enhancing cleaning efficiency and performance. As consumers increasingly seek eco-friendly and efficient cleaning solutions, manufacturers are reformulating products to include liquid sodium silicate. The market for detergents is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, which could further bolster the demand for liquid sodium silicate. This trend indicates a shift towards sustainable and effective cleaning agents, positioning liquid sodium silicate as a key ingredient in modern detergent formulations.

Rising Demand in Construction Applications

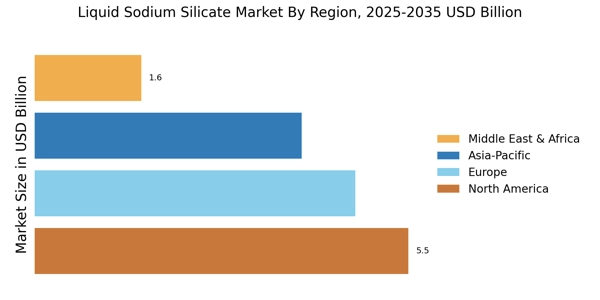

The Liquid Sodium Silicate Market is benefiting from the rising demand in construction applications. Liquid sodium silicate is widely used as a concrete hardener and sealant, contributing to the durability and longevity of construction materials. With the construction sector projected to grow at a rate of around 5% annually, the demand for liquid sodium silicate is expected to increase correspondingly. This growth is driven by urbanization and infrastructure development, particularly in emerging markets. As construction companies seek to enhance the quality and performance of their materials, liquid sodium silicate emerges as a vital component in achieving these objectives, thereby solidifying its position in the market.

Environmental Regulations Favoring Sustainable Solutions

The Liquid Sodium Silicate Market is influenced by stringent environmental regulations that favor sustainable solutions. As governments worldwide implement policies aimed at reducing environmental impact, industries are compelled to adopt eco-friendly materials. Liquid sodium silicate, being a non-toxic and biodegradable compound, aligns well with these regulatory trends. This shift towards sustainability is prompting manufacturers to explore liquid sodium silicate as a viable alternative to more harmful chemicals. The increasing emphasis on green chemistry and sustainable practices is likely to enhance the market for liquid sodium silicate, as industries seek to comply with regulations while maintaining product efficacy.