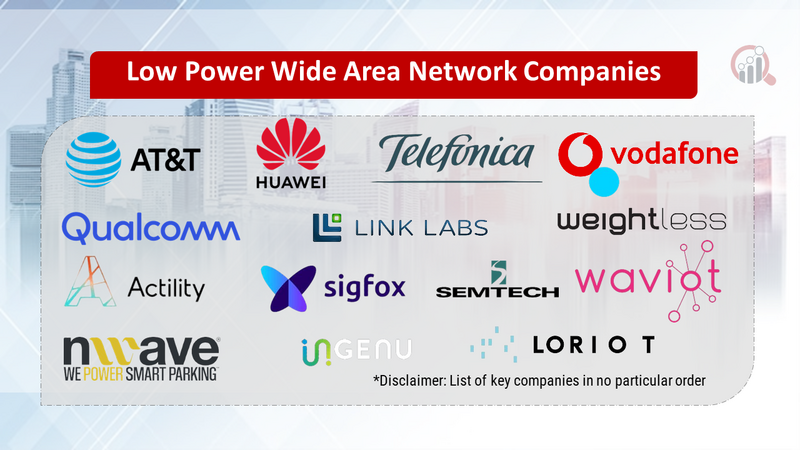

Top Industry Leaders in the Low Power WAN Market

Competitive Landscape of Low Power Wide Area Network Market: An Analysis

The Low Power Wide Area Network (LPWAN) market is experiencing explosive growth, driven by the burgeoning Internet of Things (IoT) landscape. These networks cater to low-data-rate, long-range communication needs, ideal for connecting millions of sensors and devices across vast areas. The competition within this space is fierce, with established players vying for market share alongside innovative startups.

Key Players:

- Semtech Corporation (U.S.)

- LORIOT (Switzerland)

- NWave Technologies (London)

- SIGFOX (France)

- WAVIot (U.S.)

- Cisco Systems (U.S.)

- Actility (France),

- Weightless SIG (U.K.)

- Senet Inc. (U.S.)

- AT & T Inc.(Germany)

- Huawei Technologies Co. Ltd. (China),

- Ingenu (U.S.)

- Link Labs Inc.(U.S.)

- Qualcomm Inc.(U.S.)

- Telefonica SA(Spain)

- Vodafone Group Plc. (U.K.)

Factors for Market Share Analysis:

-

Technology Specificity: Each LPWAN technology offers unique strengths and weaknesses in terms of range, power consumption, data rate, and cost. Market share will be influenced by the technologies best suited for different application segments.

-

Network Coverage and Availability: Reliable and geographically extensive network coverage is crucial for LPWAN adoption. Players with wider network presence and strategic partnerships will hold an advantage.

-

Device Ecosystem and Interoperability: A vast, compatible device ecosystem plays a significant role in market adoption. Open-source technologies and partnerships across the value chain will foster widespread device compatibility.

-

Business Models and Pricing Strategies: Flexible and competitive pricing models for network access and device subscriptions will attract customers. Players offering customized solutions and value-added services will gain an edge.

New and Emerging Companies:

Several startups are making waves in the LPWAN space, bringing innovative solutions and disrupting established players. Companies like Helium, The Things Network, and Milesight are creating community-driven LPWAN networks, utilizing low-cost hardware and alternative network architectures. These players focus on addressing specific niche applications and offering cost-effective alternatives to traditional providers.

Current Company Investment Trends:

-

Focus on Vertical Specific Solutions: Companies are increasingly tailoring their products and services to specific industry applications like smart cities, agriculture, and logistics. This allows for deep domain expertise and cater to specific customer needs.

-

Partnerships and Acquisitions: Collaboration and consolidation are key trends, with established players partnering with startups and technology providers to expand their offerings and address new markets.

-

Network Expansion and Coverage: Players are aggressively investing in expanding their network coverage to attract device manufacturers and customers seeking wider reach.

-

Advanced Chipset Development: Continuous research and development are underway to improve power efficiency, range, and data rates of LPWAN chipsets, leading to more efficient and versatile devices.

Conclusion:

The LPWAN market is a dynamic and evolving landscape. With diverse players, rapid technological advancements, and growing industry adoption, the competition is set to intensify further. Understanding the key players, their strategies, and the factors driving market share is crucial for navigating this exciting and transformative space. Companies that offer innovative solutions, cater to specific industry needs, and prioritize collaboration will be well-positioned to capture a substantial share of this rapidly expanding market.

Latest Company Updates:

-

Semtech and Microchip Partner: Semtech, a leading LPWAN chipmaker, announced a collaboration with Microchip Technology to deliver next-generation LoRaWAN solutions for industrial and smart city applications. -

Sigfox Network Expansion: Sigfox, a prominent European LPWAN provider, secured €250 million in funding to expand its global network reach and accelerate deployments in North America and Asia. -

LTE-M Gains Traction: Major mobile network operators (MNOs) are increasingly adopting LTE-M technology due to its seamless integration with existing LTE infrastructure and improved network performance.