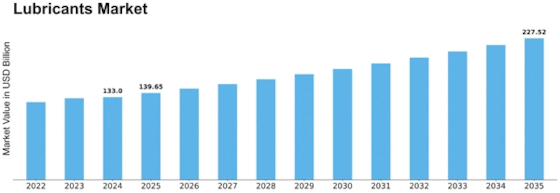

Lubricants Size

Lubricants Market Growth Projections and Opportunities

The lubricants market is shaped by various market factors that influence its growth and development. One of the primary factors driving this market is the industrial expansion across various sectors such as automotive, manufacturing, construction, and agriculture. As these industries continue to grow, there is a parallel increase in the demand for lubricants to ensure smooth operation and maintenance of machinery and equipment. Lubricants play a crucial role in reducing friction, heat, and wear between moving parts, thereby extending the lifespan of machinery and optimizing operational efficiency.

Another significant market factor is the ongoing technological advancements in lubricant formulations and manufacturing processes. Manufacturers are continuously innovating to develop lubricants that offer superior performance, longevity, and environmental sustainability. This includes the development of synthetic lubricants, bio-based lubricants, and specialty lubricants tailored to meet the specific requirements of modern machinery and equipment. Additionally, advancements in additive technology contribute to enhancing the lubricating properties and overall performance of lubricants, driving the demand for high-quality lubricant products.

Moreover, regulatory policies and environmental standards play a crucial role in shaping the lubricants market. Governments worldwide are implementing stricter regulations aimed at reducing emissions, promoting energy efficiency, and minimizing environmental impact. Compliance with these regulations necessitates the use of environmentally friendly lubricants that are biodegradable and non-toxic. As a result, there is a growing demand for eco-friendly lubricant solutions, driving manufacturers to invest in research and development to develop sustainable lubricant formulations.

Furthermore, the evolving automotive industry landscape influences the lubricants market dynamics. The increasing demand for fuel-efficient vehicles and electric vehicles (EVs) has led to changes in engine designs and lubricant requirements. Modern engines require lubricants that can withstand higher temperatures, reduce friction losses, and improve fuel efficiency. Additionally, the rise of EVs necessitates the development of specialized lubricants for electric drivetrains and battery systems, presenting new opportunities for lubricant manufacturers to innovate and diversify their product offerings.

The competitive landscape of the lubricants market also plays a significant role in shaping its dynamics. With numerous multinational and regional players competing for market share, there is intense competition in terms of product innovation, pricing, and distribution channels. Manufacturers are increasingly focusing on expanding their global footprint through strategic partnerships, acquisitions, and alliances to gain a competitive edge in the market. Additionally, branding and marketing initiatives play a vital role in influencing consumer perceptions and preferences, driving customer loyalty and market penetration.

Economic factors such as GDP growth, industrial output, and infrastructure development also impact the lubricants market. As economies grow and industrial activities expand, there is a corresponding increase in the demand for lubricants across various sectors. Moreover, infrastructure development projects, such as road construction, mining, and oil and gas exploration, drive the demand for lubricants used in heavy-duty machinery and equipment, further fueling market growth.

Leave a Comment