- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

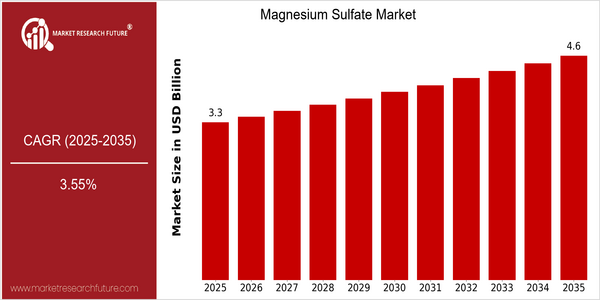

Magnesium Sulphate Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 3.32 Billion |

| 2035 | USD 4.62 Billion |

| CAGR (2025-2035) | 3.55 % |

Note – Market size depicts the revenue generated over the financial year

The market for magnesium sulphate is expected to grow steadily. It is expected to reach a value of $ 3.32 billion in 2025, and is forecast to rise to $ 4.62 billion by 2035. This growth rate is a compound annual growth rate (CAGR) of 3.55% over the forecast period. It is mainly due to the rising demand for magnesium sulphate as a fertilizer and soil improver, which improves crop yield and quality. The pharmaceutical industry also uses magnesium sulphate for a variety of medical purposes, such as treating eclampsia and as a laxative. The development of new applications and the improvement of production processes are also important growth drivers. The major companies such as Compass Minerals and K+S AG are investing in R & D to improve the performance of their products and expand their market share. Strategic alliances and collaborations to improve logistics and distribution will also play an important role in the competition of magnesium sulphate. These trends will continue to evolve in the future, and they will contribute to the steady growth and diversification of the market in the future.

Regional Deep Dive

Magnesium sulfate is a chemical compound used in the manufacture of magnesium sulfate. It is used in many industries, such as agriculture, pharmaceuticals and food. In North America, the market is driven by the increasing demand for magnesium sulfate as a fertilizer and as a mineral supplement in the food industry. The region is also characterized by high manufacturing capabilities and strict regulations to ensure the safety and quality of products. The growing trend of sustainable agriculture in this region is expected to further boost the market.

North America

- The use of magnesium sulphate in organic farming has been approved by the United States Department of Agriculture, and it has become increasingly common among organic farmers.

- The leading magnesium sulphate producers are Compass Minerals and American Vanguard, which are investing in new production methods to improve the extraction and processing of magnesium sulphate.

- Among the reasons for the high growth of the magnesium sulphate market is the new regulatory framework for the fertilizer industry, which requires manufacturers to produce fertilizer with lower magnesium content.

Europe

- The European Green Deal has aroused interest in environment-friendly fertilizers, with magnesium sulphate being recognized as having a low impact on the environment compared with conventional fertilizers.

- The magnesium sulfate solutions of K+S AG and Nutrients Inc. have been adapted to the European market and the sustainable and organic farming.

- The results of recent studies which have highlighted the beneficial properties of magnesium sulphate in food have raised the demand for this product and have affected the market dynamics.

Asia-Pacific

- China and India, with their rapidly developing industries, have been the main consumers of magnesium sulphate.

- In India the government has been promoting the use of magnesium sulphate in agriculture, especially in the growing of rice and wheat, for the purpose of increasing the yield of these two cereals.

- Production techniques, the development of more efficient extraction methods, have been adopted by the local industry to meet the growing demand.

MEA

- In the Near and Middle East, and in Africa, the agricultural development is advancing with the object of securing the food supply. The improvement of the soil is a main concern.

- The Arab Potash Company is looking for partners to increase its magnesium sulphate production to meet the growing demand for the mineral.

- In several African countries, legislation promoting the use of magnesium sulphate in agriculture is in the process of being formulated, which is expected to increase market penetration.

Latin America

- Brazil’s agriculture sector is adopting magnesium sulphate as an essential crop nutrient, driven by the need to increase productivity in a competitive market.

- The local companies are also focusing on sustainable development and are now producing magnesium sulphate from natural sources, which fits in with the worldwide trend towards more natural products.

- The use of magnesium sulphate is recommended in the governmental programmes for improving agricultural efficiency. The market for magnesium sulphate is expected to grow in the region.

Did You Know?

“Magnesium sulphate is not only used in agriculture, but also plays a vital role in medicine, especially in the treatment of eclampsia and pre-eclampsia in pregnant women.” — World Health Organization

Segmental Market Size

Magnesium sulfate market is characterized by its stable demand, which is mainly driven by its applications in agriculture, pharmaceuticals, and industrial processes. The major driving forces of this market are the increasing demand for magnesium in crop production to improve the quality and yield of crops, and the increasing use of magnesium sulfate in medical treatments, such as eclampsia. Furthermore, the regulations promoting sustainable agriculture practices are expected to drive demand.

Today, the market for magnesium sulfate is mature, and well-known suppliers such as Compass Minerals and K+S Aktiengesellschaft are actively providing magnesium sulfate to the market. The main application of magnesium sulfate is fertilizer in agriculture, laxative in pharmaceuticals and coagulant in food industry. The trend of organic farming and sustainable development will also accelerate the development of the industry, and the extraction and processing technology, such as the development of crystallization, will also have a certain impact on the industry.

Future Outlook

From 2025 to 2035, the magnesium sulfate market will grow steadily from $3.32 billion to $ 4.62 billion, with a compound annual growth rate (CAGR) of 3.55%. It is due to the increasing demand for magnesium sulfate in various applications, such as agriculture, pharmaceuticals and industrial processes. Farmers are increasingly using magnesium sulfate as a nutrient to improve the quality of the soil and the yield of the crops. The share of magnesium sulfate in the agricultural sector is expected to be about 25% of the total market by 2035, highlighting its importance in sustainable farming.

The magnesium sulfate market is mainly influenced by technological development and the government's policy. The extraction and production process will be improved, and the cost will be reduced, and magnesium sulfate will be more widely used. The government policy will also support the development of magnesium sulfate, and the development of magnesium sulfate will be promoted. Also, the trend of precision agriculture will also increase the use of magnesium sulfate, and the farmers will optimize the use of fertilizer and increase the hardiness of the soil. This will drive the development of magnesium sulfate.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.1 Billion |

| Market Size Value In 2023 | USD 1.1605 Billion |

| Growth Rate | 5.50%(2023-2032) |

Magnesium Sulphate Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.