Pharmaceutical Sector Growth

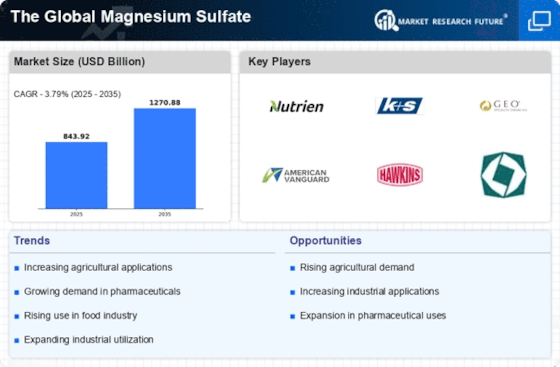

The pharmaceutical industry is witnessing a notable increase in the utilization of magnesium sulfate Market, particularly in the production of medications and treatments. This compound is employed in various medical applications, including as a laxative, an electrolyte replenisher, and in the treatment of conditions such as eclampsia. The Global Magnesium Sulfate Industry benefits from this trend, as the pharmaceutical segment is projected to grow at a compound annual growth rate (CAGR) of around 4% over the next few years. The rising prevalence of chronic diseases and the ongoing development of innovative pharmaceutical products are likely to further enhance the demand for magnesium sulfate, positioning it as a critical component in healthcare.

Rising Demand in Agriculture

The increasing emphasis on sustainable agriculture practices is driving the demand for magnesium sulfate Market in the agricultural sector. This compound is recognized for its role as a vital nutrient in crop production, enhancing plant growth and yield. In the agricultural sector, magnesium sulfate is utilized as a fertilizer, particularly in the cultivation of crops such as potatoes, tomatoes, and various fruits. The market data indicates that the agricultural segment accounts for a substantial share of The Global Magnesium Sulfate Industry, with projections suggesting a growth rate of approximately 5% annually. This trend reflects a broader shift towards organic farming and the need for environmentally friendly agricultural inputs, thereby bolstering the market's expansion.

Industrial Applications and Innovations

The expansion of industrial applications for magnesium sulfate Market is a significant driver of The Global Magnesium Sulfate Industry. This compound is increasingly utilized in various industries, including textiles, paper, and food processing. Its properties as a drying agent and a coagulant make it valuable in these sectors. Recent market data suggests that the industrial segment is experiencing a growth trajectory, with an estimated increase of 6% in demand over the next five years. Innovations in manufacturing processes and the development of new applications are likely to contribute to this growth, as industries seek to optimize their operations and enhance product quality.

Environmental Regulations and Compliance

The implementation of stringent environmental regulations is influencing The Global Magnesium Sulfate Industry. Industries are increasingly required to adopt eco-friendly practices, leading to a heightened interest in magnesium sulfate Market as a sustainable alternative. This compound is often favored for its low environmental impact compared to other chemical alternatives. As companies strive to comply with regulations and improve their sustainability profiles, the demand for magnesium sulfate is expected to rise. Market analysts indicate that this trend could result in a growth rate of approximately 5% in the coming years, as industries prioritize environmentally responsible practices.

Growing Awareness of Nutritional Benefits

There is a growing awareness of the nutritional benefits of magnesium sulfate Market, particularly in dietary supplements and health products. Consumers are increasingly seeking products that enhance their overall well-being, and magnesium sulfate Market is recognized for its role in supporting various bodily functions, including muscle and nerve function. The Global Magnesium Sulfate Industry is likely to benefit from this trend, as the dietary supplement segment is projected to grow at a CAGR of around 4.5% in the next few years. This shift in consumer preferences towards health and wellness products is expected to drive demand for magnesium sulfate, positioning it as a key ingredient in the nutritional market.