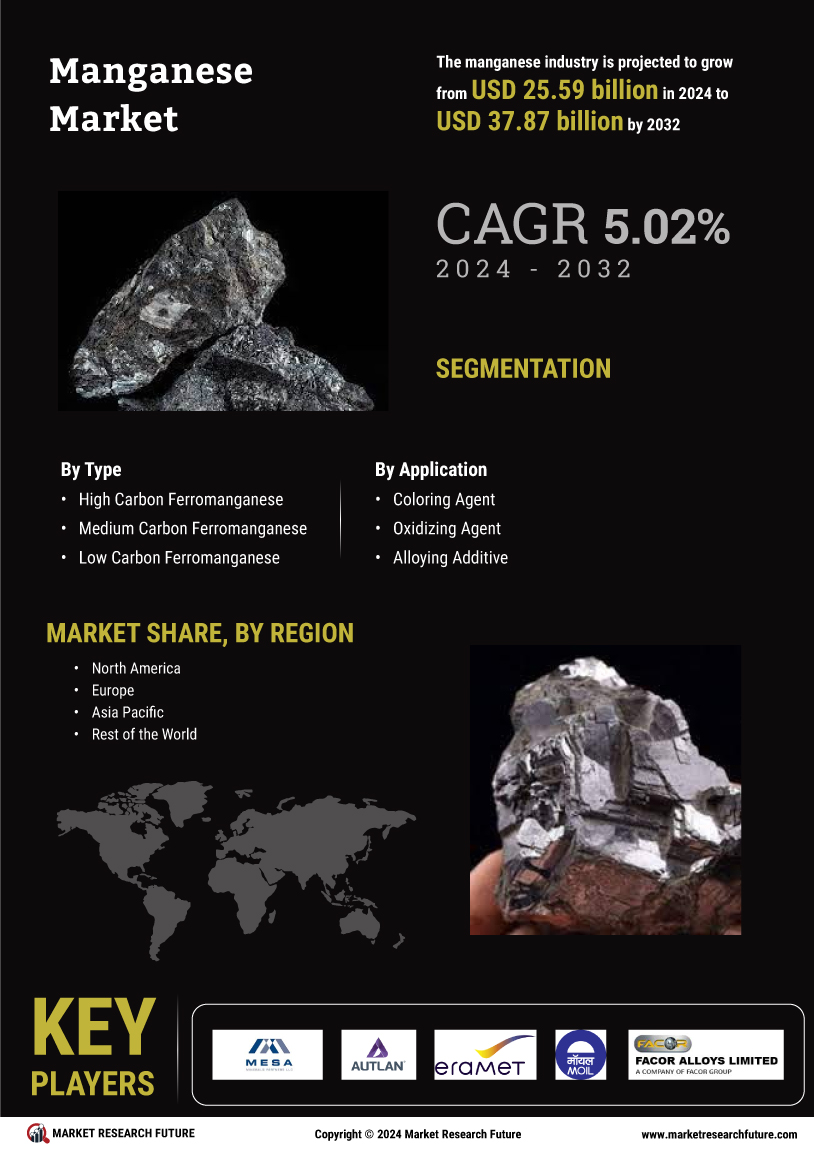

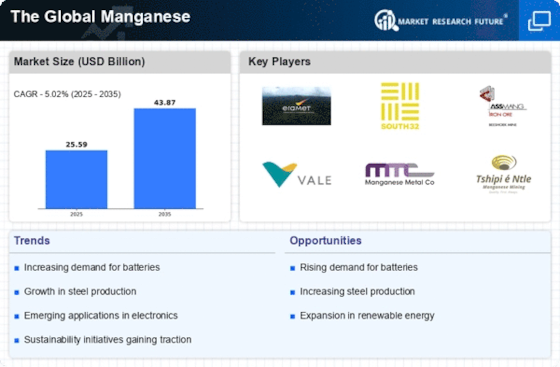

Manganese Market Summary

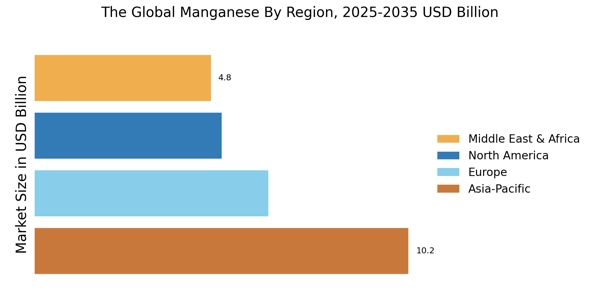

As per Market Research Future analysis, the Global Manganese Market Size was estimated at 9792.09 USD Million in 2024. The Genset industry is projected to grow from 10456.97 USD Million in 2025 to 18007.78 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Manganese Market is experiencing robust growth driven by the rising demand from the steel industry continues to drive market growth, as manganese remains an essential alloying element for improving steel strength, hardness, and durability. The expanding construction, automotive, and infrastructure sectors are significantly boosting consumption.

- Increasing use of manganese in battery technologies, particularly in lithium-ion and emerging lithium-manganese-iron-phosphate (LMFP) chemistries, is accelerating market expansion. The rapid growth of electric vehicles (EVs) and energy storage systems (ESS) is creating new long-term demand opportunities.

- High production and operational costs, coupled with supply-chain fluctuations, remain major restraints for the market. Variability in ore quality, mining logistics, and price volatility in key producing countries can impact profitability and supply stability.

- Growing adoption of high-purity manganese products, driven by heightened environmental policies, stricter emission regulations, and rising demand for cleaner energy technologies. This shift is strengthening investment in refining and production of high-purity manganese sulfate (HPMSM) for battery applications.

- Technological advancements in mining automation, AI-enabled resource estimation, and process optimization are supporting higher production efficiency. The integration of digital tools across mining and processing operations is improving ore recovery rates, lowering operational risks, and enabling sustainable manganese extraction.

Market Size & Forecast

| 2024 Market Size | 9792.09 (USD Million) |

| 2035 Market Size | 18007.78 (USD Million) |

| CAGR (2025 - 2035) | 5.6 % |

Major Players

Eramet, South32, MOIL Limited, Jupiter Mines, LHG Mining, OM Holdings Limited, United Manganese of Kalahari, Assmang Proprietary Limited, Anglo American, and AML Holdings LLC.