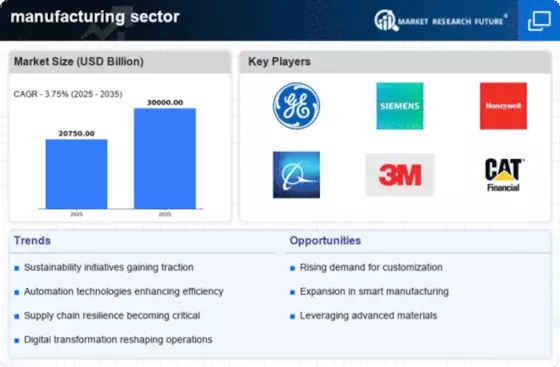

North America : Manufacturing Powerhouse

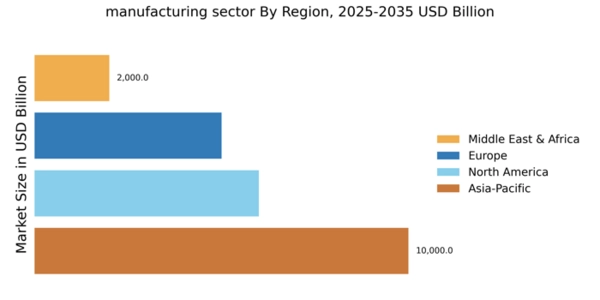

North America is poised for significant growth in the manufacturing sector, driven by technological advancements and a skilled workforce. The region's market size is projected at $6000.0 million, reflecting a robust demand for innovative manufacturing solutions. Regulatory support, including incentives for automation and sustainability, is further catalyzing growth. The focus on reshoring and supply chain resilience is also contributing to the sector's expansion. The United States leads the North American market, with key players like General Electric, Honeywell, and Boeing driving innovation and competitiveness. The presence of advanced manufacturing technologies, such as IoT and AI, enhances operational efficiency. Additionally, the region's strong infrastructure and investment in R&D position it favorably against global competitors, ensuring a dynamic manufacturing landscape.

Europe : Innovation and Sustainability Focus

Europe's manufacturing sector is undergoing a transformation, with a market size of $5000.0 million. The region is focusing on sustainability and digitalization, driven by stringent regulations and consumer demand for eco-friendly products. The European Green Deal and Industry 4.0 initiatives are pivotal in shaping the future of manufacturing, promoting innovation and reducing carbon footprints. This regulatory environment is fostering a shift towards more sustainable practices across industries. Germany, France, and Italy are leading the charge in Europe, with major players like Siemens and Schneider Electric at the forefront. The competitive landscape is characterized by a strong emphasis on R&D and collaboration between industry and academia. The presence of advanced manufacturing technologies, such as robotics and automation, is enhancing productivity and efficiency, positioning Europe as a leader in the global manufacturing arena.

Asia-Pacific : Emerging Manufacturing Hub

Asia-Pacific is the largest manufacturing market globally, with a market size of $10000.0 million. The region's growth is fueled by rapid industrialization, urbanization, and a burgeoning middle class demanding diverse products. Countries like China and India are at the forefront, supported by favorable government policies and investments in infrastructure. The region's focus on technology adoption, including automation and smart manufacturing, is further driving demand and efficiency in production processes. China remains the dominant player in the Asia-Pacific manufacturing landscape, with significant contributions from Japan and South Korea. Key players such as Hitachi and ABB are leveraging advanced technologies to enhance competitiveness. The competitive environment is marked by a mix of large multinational corporations and agile local firms, creating a dynamic ecosystem that fosters innovation and growth in the manufacturing sector.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is witnessing a gradual growth in the manufacturing sector, with a market size of $2000.0 million. This growth is driven by diversification efforts away from oil dependency, with governments investing in manufacturing as a key economic driver. Initiatives aimed at enhancing local production capabilities and attracting foreign investment are pivotal in shaping the sector's future. The region's young population and increasing urbanization are also contributing to rising demand for manufactured goods. Countries like South Africa and the UAE are leading the way in the MEA manufacturing landscape, with a focus on sectors such as automotive and consumer goods. The presence of key players and investments in technology are enhancing the region's competitiveness. However, challenges such as infrastructure deficits and regulatory hurdles remain, necessitating strategic initiatives to unlock the full potential of the manufacturing sector.