Research Methodology on Marine Engine Market

For this research, Market Research Future (MRFR) has employed both primary and secondary research instruments to collate all the data from the market.

Primary Research

The primary research is conducted to understand the Marine Engine Market size, growth, and key decision-makers and industry experts. The interviews of C-level personnel (CTO, CEO, CIO, CFO and other executives) were conducted to understand the Marine Engine Market in different geographic regions. The primary research process also includes surveys and an in-depth discussion with industry professionals and opinions are collected from them regarding the Marine Engine Market. Many sources of secondary data are referred to identify and collect accurate data, which further assists the team in analyzing the Marine Engine Market.

Secondary Research

In secondary research, various industry and government publications, journals, press releases, and various websites, such as Investing News, Wikipedia and other government websites, are referred to, which enables us to understand the market on a deeper level.

Market Size Estimations

The top-down method is used to estimate and validate the overall market size. In this method, the revenue generated in the global Marine Engine Market is taken as the base year, which is divided into the number of regions, and the total revenue is calculated by multiplying the revenue generated by each region. The bottom-up method is employed to derive the exact numbers and estimated the market size of segments, such as fuel type and power range.

Data Triangulation

The data triangulation method is implemented by MRFR in order to validate the data and to provide a better market understanding of the Marine Engine Market. The data triangulation process includes primary interviews, statistical data, and a bottom-up approach.

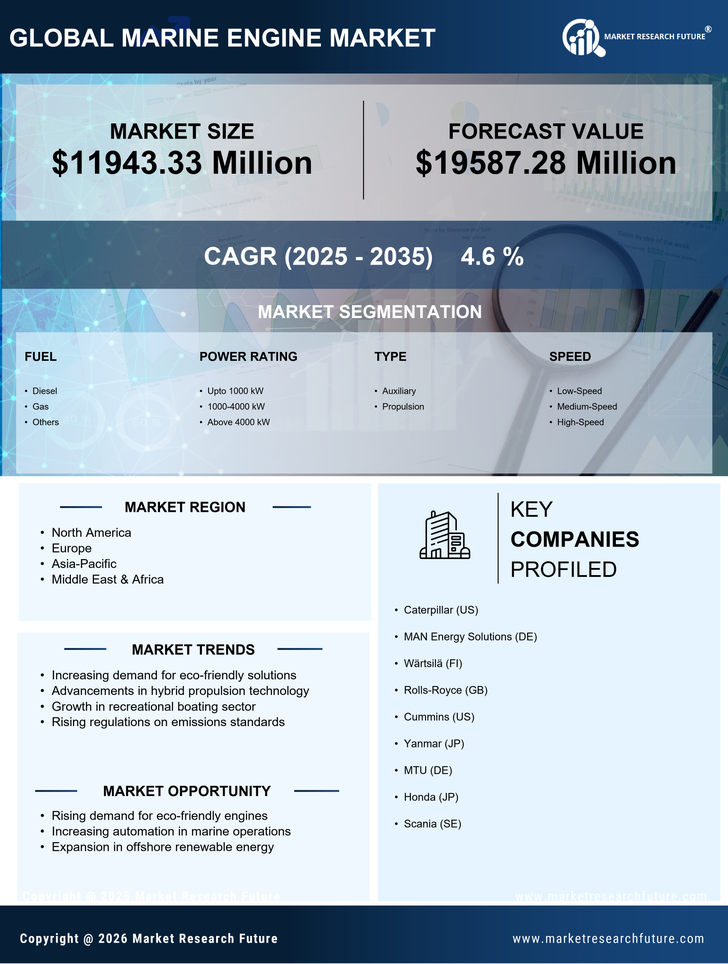

Key Industry Insights

The report on the global Marine Engine Market provides insights into the key security trends, pricing analysis, competitive market landscape and key vendor strategies. Moreover, detailed information on the regulatory landscape and various strategies to accommodate the latest industry trends is included in the report. Additionally, the report offers a detailed evaluation of the cost structure and supply chain structure of the market.

Key Players

The prominent players in the global Marine Engine Market include Caterpillar Inc. (US), Wärtsilä Corporation (Finland), Northern Lights, Inc. (US), Cummins Inc. (US), Deere & Company (US), General Electric (US), MAN Diesel & Turbo SE (Germany), Volvo Penta (Sweden), Rolls-Royce plc (UK), Scania AB (Sweden) and MAN Engines & Services.

Market Segmentation

The global Marine Engine Market is further segmented based on fuel type, design type and power range. On the basis of fuel type, the market is bifurcated into gasoline and diesel. Diesel-based marine engines are more popular compared to gasoline as they provide more power and efficiency. Based on design type, the market is segmented into inboard and outboard. Inboard design is more popular as these engines are hidden inside the boat, as opposed to outboard engines, which are mounted onto the transom and are more exposed. On the basis of power range, the market is segmented into power below 400 HP and power above 400 HP.

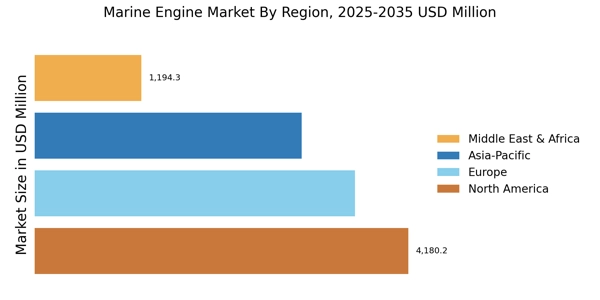

Regional Analysis

The global Marine Engine Market covers five major key regions, namely, Asia-Pacific, Europe, Middle East & Africa, North America and South America. North America holds a major share of the global Marine Engine Market owing to the presence of top industry players in the region and increased investments in the research and development of these engines. Europe is the second largest market for Marine engines, owing to the stringent regulations regarding fuel efficiency and emissions. Asia-Pacific is anticipated to be the fastest-growing region in the Marine engine market due to increasing demand from shipping and boating activities in the region. The African and South American regions are projected to witness healthy growth in the near future, as investments will lead to the development of new powerboats as well as the expansion of fishing fleets in the regions.

Conclusion

The report provides insights into the market drivers, restraints, and opportunities, which are likely to impact the market during the forecast period 2023 to 2030. The report further provides an in-depth analysis of the various trends and provides an analysis of the key market segments. With the increasing demand for maritime travel, the market for Marine engines is likely to be positively impacted. The report provides insights into the strategies adopted by the key players in the market. Further, it provides an in-depth analysis of the market based on regional analysis and segments.