Market Trends

Key Emerging Trends in the Marine Hybrid Propulsion System Market

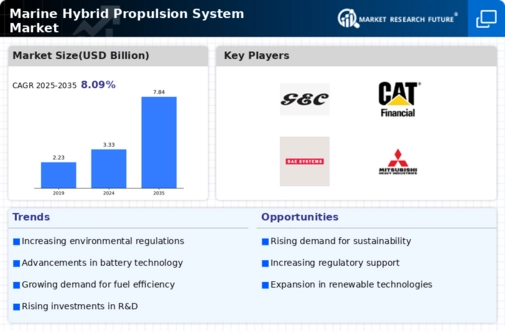

The Marine Hybrid Propulsion System market is undergoing a shift as more players in the marine sector adopt eco-friendly technologies that cut on fuel consumption. In response to prevailing trends such companies use various strategies to improve its position in terms of shares through differentiating themselves from competitors creating competitive edge. This could be done through developing hybrid drives having unique features like environmental friendliness making it consume less fuel polluting air lesser than normal engines do thereby providing owners incentives to purchase them unlike traditional ones which are non-compliant with prevailing environmental guidelines. As long as there is increasing interest among ship owners/operators about cleaner options, advertising sustainability solutions specifically tailored for marine applications will bring higher profit margins.

Cost leadership is another important strategy in the Marine Hybrid Propulsion System market. Some companies focus on improving their manufacturing processes, lowering the cost of key components to make hybrid propulsion systems more affordable. This strategy has an impact on customers who are concerned with prices especially for those who need to purchase a lot of this product for use. Through providing less costly yet advanced hybrid propulsion solutions, firms try to obtain as many potential clients as possible.

Market share position in Marine Hybrid Propulsion System sector mainly depends on innovation. Companies invest heavily in research and development to come up with new technologies such as energy-storage devices and propulsion systems. For example introduction of modern batteries into the hybrid systems with regenerative abilities signifies commitment to creativity by these manufacturers. By being ahead of technology, they are able not only to meet changing customer needs but also become leaders themselves thereby attracting those customers that value such powerful marine engines.

Collaboration and partnerships are widely used strategies in this industry among various players involved in manufacturing or supplying products for this industry like shipbuilders, maritime industry stakeholders and clean energy providers. This is particularly useful where enterprises integrate into the entire maritime ecosystem; working jointly with leading ship design and production experts could greatly enhance their market positions. In some markets, this approach has been extremely efficient since collaborative efforts between industries heavily influences the decisions made by consumers when purchasing.

Leave a Comment