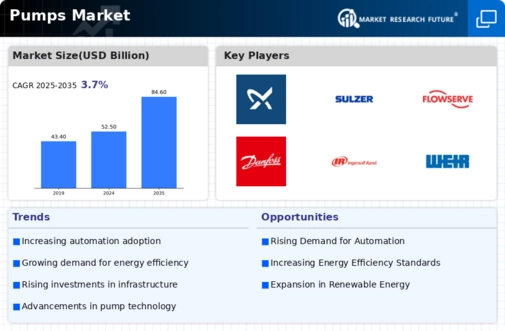

Pumps Market Summary

As per Market Research Future Analysis, the Global Pumps market was valued at USD 52.51 billion in 2024 and is projected to grow to USD 78.48 billion by 2035, with a CAGR of 3.72% from 2025 to 2035. The growth is driven by the expanding building and construction, food and beverage industries, and increasing demand for water and wastewater treatment facilities, particularly in regions facing water scarcity like China and India. The positive displacement segment leads the market, supported by its demand in the oil and gas industry. North America accounted for USD 52.51 billion in 2024, with significant growth expected due to increased construction activity and technological advancements.

Key Market Trends & Highlights

Key trends influencing the pumps market include environmental concerns and technological advancements.

- Growing need for water treatment facilities due to water scarcity, especially in China and India.

- Positive displacement pumps dominate the market, particularly in the oil and gas sector.

- North America pumps market valued at USD 20.1 billion in 2021, with significant growth expected.

- Emerging economies are increasingly investing in wastewater treatment and infrastructure improvements.

Market Size & Forecast

| 2024 Market Size | USD 52.51 Billion |

| 2035 Market Size | USD 78.48 Billion |

| CAGR (2024-2035) | 3.72% |

Major Players

Major players include Grundfos (Denmark), Sulzer (Switzerland), Flowserve (US), ITT Corporation (US), Danfoss (Denmark), Ingersoll-Rand (Ireland), The Weir Group (UK), Ebara Corp (Japan), KSB (Germany), Schlumberger (US), Nikkiso Co Ltd (Japan), Wilo AG (Germany), and Roper Industries (US).