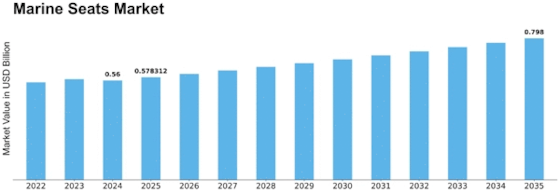

Marine Seats Size

Marine Seats Market Growth Projections and Opportunities

The Marine Seats industry depends on various factors that combine to make its growth and development possible in the maritime sector. One of the major drivers of this market is the worldwide growth of marine as well as boating sectors. Exhibiting continued growth in their maritime activities such as commercial shipping, leisure sailing, and naval operations has caused a growing demand for comfortable, ergonomic and durable seating solutions. In different marine applications, it is marine seats which are vital in enabling them achieve both comfort and safety for sellers plus passengers.

Technological advancement also plays a significant role in shaping the dynamics of Marine Seats market. Developments in materials, designs, production methods lead to creation of lightweight, corrode resistant and weatherproofed seats. Such innovative features include adjustable ergonomics, shock mitigation systems and integrated safety measures increasing both user experience as well as performance by these products. Manufacturers always aim at satisfying evolving needs of their consumers with respect to technology thereby sparking off competitiveness and innovation within marine seating industry.

In the Marine Seats market regulatory standards are important considerations for buyer decision making process regarding purchasing decisions related to the product or service under consideration .These authorities impose the requirement for strict seat construction guidelines as well as safety feature regulations before they become accepted international maritime safety standards enforcement agencies globally. Therefore manufactures must comply with these rules while designing and producing marine seats which tend to focus more on exceeding rather than meeting safety requirements set forth by regulation authorities . Safety certifications and compliance with industrial standards require careful considerations when developing products so as to ensure that they meet quality requirements besides being competitive in terms of pricing and overall cost.

Another major factor contributing increased demand for high quality marine seat is growth in marine tourism leisure industry . There is greater need for fancy sitting spaces because many individuals have taken up hobbies like boat riding , luxury yachting or even taking cruises . The main concern here becomes achievement of highly designed seats that will offer fashionable style along with functionality , safety and comfort for high-end clients who are after gaining maximum onboard experiences.

Marine Seats market dynamics are also influenced by economic factors including global trade changes as well as consumer spending. Economic conditions and therefore could be a driving force behind any shipbuilding, commercial shipping demands and even the overall consumers’ purchasing power in relation to the maritime industry. The situation of economic stability and growth triggers investors into making more investments in new vessels and marine equipment such as seating solutions; on the other hand, when economy is moving toward downturns, investors become more conservative while upgrading or buying new marine seats.

Moreover, environmental concerns affect the market; which is increasingly focusing on sustainable and environmentally friendly materials in marine seat production . Being pressurized to minimize their environmental footprints , manufacturers consider using recyclable materials , becoming less polluting when producing marine seats among other initiatives . Such practices are consistent with general tendencies within this sector thereby positioning themselves as environmentally responsive firms within this line of business.

Leave a Comment