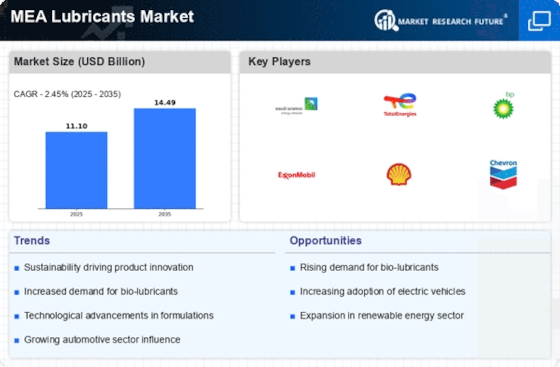

Rising Automotive Production

The MEA Lubricants Market is experiencing a notable surge due to the increasing automotive production in the region. As countries within the Middle East and Africa enhance their manufacturing capabilities, the demand for lubricants is expected to rise correspondingly. In 2025, the automotive sector is projected to contribute significantly to lubricant consumption, with estimates suggesting a growth rate of approximately 4.5% annually. This growth is driven by the need for high-performance lubricants that can withstand extreme temperatures and conditions prevalent in the region. Consequently, manufacturers are focusing on developing advanced formulations tailored to meet the specific requirements of automotive applications, thereby propelling the MEA Lubricants Market forward.

Increased Focus on Energy Efficiency

The MEA Lubricants Market is increasingly influenced by the growing emphasis on energy efficiency and sustainability. As industries strive to reduce operational costs and environmental impact, the demand for lubricants that enhance energy efficiency is on the rise. Research indicates that energy-efficient lubricants can reduce friction and wear, leading to lower energy consumption in machinery. This trend is particularly relevant in sectors such as manufacturing and transportation, where energy costs constitute a significant portion of operational expenses. Consequently, lubricant manufacturers are innovating to develop products that not only meet performance standards but also align with sustainability goals, thereby shaping the future of the MEA Lubricants Market.

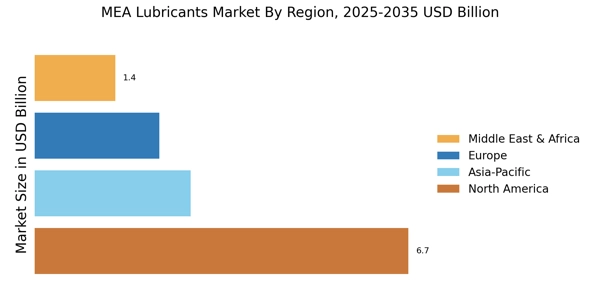

Industrial Growth and Infrastructure Development

The MEA Lubricants Market is poised for expansion, largely due to the rapid industrial growth and infrastructure development across the region. Countries are investing heavily in sectors such as construction, mining, and manufacturing, which in turn drives the demand for industrial lubricants. The construction sector alone is expected to witness a compound annual growth rate of around 5% through 2025, necessitating the use of high-quality lubricants to ensure machinery efficiency and longevity. This trend indicates a robust market for lubricants that cater to heavy machinery and equipment, thus enhancing the overall performance and reliability of industrial operations within the MEA Lubricants Market.

Regulatory Compliance and Environmental Standards

The MEA Lubricants Market is significantly impacted by the evolving regulatory landscape and stringent environmental standards. Governments across the region are implementing regulations aimed at reducing emissions and promoting the use of environmentally friendly lubricants. This regulatory push is driving manufacturers to innovate and develop products that comply with these standards while maintaining performance. The market for bio-based and biodegradable lubricants is expected to grow as industries seek to align with sustainability initiatives. As a result, companies that proactively adapt to these regulations are likely to gain a competitive edge in the MEA Lubricants Market, fostering a shift towards greener alternatives.

Technological Innovations in Lubricant Formulations

The MEA Lubricants Market is witnessing a transformation driven by technological innovations in lubricant formulations. Advances in chemistry and materials science are enabling the development of high-performance lubricants that offer superior protection and efficiency. For instance, synthetic lubricants are gaining traction due to their enhanced thermal stability and longer service life compared to conventional oils. This shift is expected to result in a market growth rate of approximately 6% annually as industries increasingly adopt these advanced products. Furthermore, the integration of nanotechnology in lubricant formulations is emerging as a game-changer, providing additional benefits such as improved wear resistance and reduced friction, thus propelling the MEA Lubricants Market into a new era of performance.

Leave a Comment