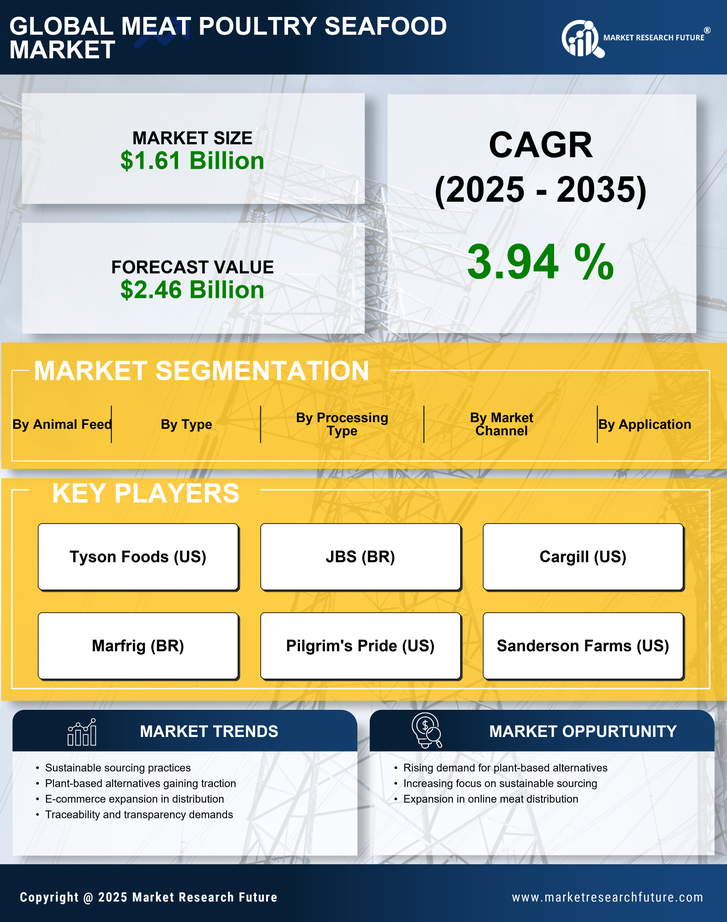

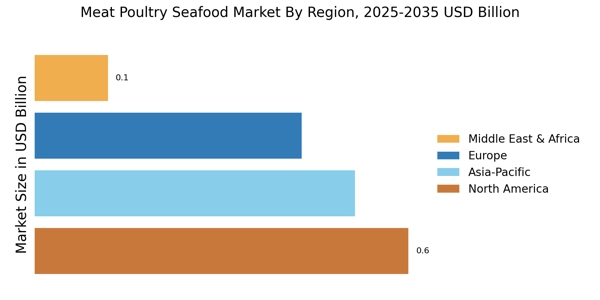

North America : Market Leader in Production

North America is the largest market for meat, poultry, and seafood, accounting for approximately 35% of the global market share. The region benefits from advanced agricultural practices, high consumer demand for protein-rich diets, and a robust supply chain. Regulatory support, including food safety standards and trade agreements, further catalyzes growth. The U.S. is the primary contributor, followed by Canada, which is experiencing a surge in poultry consumption. The competitive landscape is dominated by major players such as Tyson Foods, Cargill, and Pilgrim's Pride, which have established strong market positions through innovation and sustainability initiatives. The presence of these key players ensures a steady supply of diverse meat products, catering to both domestic and international markets. The region's focus on quality and safety standards enhances consumer trust, driving further demand.

Europe : Sustainable Practices in Focus

Europe is witnessing a significant shift towards sustainable meat production, holding approximately 25% of the global market share. The region's growth is driven by increasing consumer awareness regarding health and environmental impacts, alongside stringent regulations promoting animal welfare and sustainability. Countries like Germany and France are leading this trend, with a growing preference for organic and locally sourced products, which is reshaping the market landscape. The competitive environment features key players such as Danish Crown and JBS, who are adapting to changing consumer preferences by investing in sustainable practices. The European market is characterized by a diverse range of products, including specialty meats and plant-based alternatives. This adaptability, combined with a strong regulatory framework, positions Europe as a leader in the transition towards a more sustainable meat industry.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is rapidly emerging as a significant player in the meat, poultry, and seafood market, accounting for approximately 30% of the global market share. The region's growth is fueled by rising disposable incomes, urbanization, and changing dietary preferences, particularly in countries like China and India. Regulatory frameworks are evolving to support food safety and quality, which is essential for meeting the increasing demand for meat products. Leading countries in this region include China, Japan, and India, where traditional consumption patterns are shifting towards more protein-rich diets. Key players such as Nippon Suisan Kaisha and Mowi are expanding their operations to cater to this growing demand. The competitive landscape is becoming increasingly dynamic, with both local and international companies vying for market share, driving innovation and product diversification.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is poised for significant growth in the meat, poultry, and seafood market, currently holding about 10% of the global market share. Factors such as population growth, urbanization, and increasing meat consumption are driving this trend. Regulatory bodies are beginning to implement stricter food safety standards, which will enhance consumer confidence and stimulate market growth. Countries like South Africa and the UAE are leading the charge in meat consumption, with a growing preference for imported products. The competitive landscape is characterized by a mix of local and international players, with companies like Seaboard Foods and Marfrig expanding their presence in the region. The demand for diverse meat products is rising, driven by changing consumer preferences and the influence of Western diets. This presents a unique opportunity for market entrants to capitalize on the untapped potential in this region.