Increase in Patient Volume

The Medical Billing Market is witnessing growth due to an increase in patient volume across healthcare facilities. Factors such as an aging population and rising prevalence of chronic diseases contribute to this trend, leading to more patients seeking medical care. As patient numbers rise, healthcare providers face the challenge of managing billing processes efficiently to ensure timely reimbursements. This surge in patient volume necessitates robust medical billing solutions that can handle increased workloads without compromising accuracy. Market data indicates that the number of patient visits to healthcare facilities is expected to rise significantly in the coming years, further driving the demand for effective billing services. Consequently, companies that can provide scalable and efficient billing solutions are likely to benefit from this trend within the Medical Billing Market.

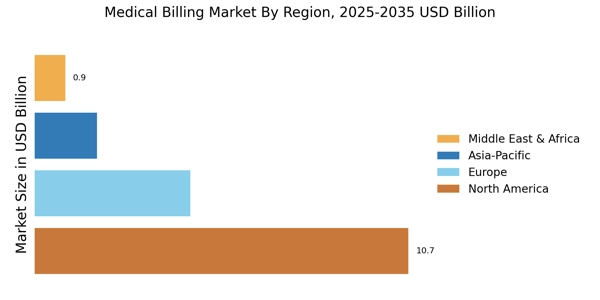

Rising Healthcare Expenditure

The Medical Billing Market is experiencing growth due to rising healthcare expenditure across various regions. As healthcare costs continue to escalate, both public and private sectors are investing heavily in healthcare services. This increase in expenditure translates to a higher volume of medical services rendered, which in turn necessitates efficient billing processes. According to recent data, healthcare spending is projected to increase at a compound annual growth rate (CAGR) of approximately 5% over the next few years. This trend indicates a growing need for medical billing services that can handle the complexities associated with increased service volume. As healthcare providers seek to optimize their revenue cycles, the demand for advanced billing solutions is likely to rise, further propelling the Medical Billing Market forward.

Shift Towards Value-Based Care

The Medical Billing Market is evolving due to a shift towards value-based care models. This transition emphasizes quality of care over the volume of services provided, necessitating a reevaluation of billing practices. Healthcare providers are increasingly required to demonstrate the value of their services, which impacts how billing is conducted. As a result, there is a growing demand for billing solutions that can accurately capture and report on quality metrics. This shift is reflected in the market, where solutions that support value-based reimbursement models are gaining traction. Recent projections suggest that the value-based care market could account for a significant portion of healthcare spending in the near future. Therefore, companies that adapt their billing practices to align with this trend are likely to find new opportunities within the Medical Billing Market.

Adoption of Advanced Technologies

The Medical Billing Market is significantly impacted by the adoption of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the efficiency and accuracy of billing processes, reducing errors and improving revenue cycle management. The integration of AI-driven solutions allows for automated coding and billing, which streamlines operations and minimizes the time taken for claims processing. As healthcare organizations increasingly recognize the benefits of these technologies, the market for tech-enabled billing solutions is expected to expand. Recent estimates suggest that the market for AI in healthcare billing could reach several billion dollars by the end of the decade. This technological shift not only improves operational efficiency but also positions companies favorably within the competitive landscape of the Medical Billing Market.

Regulatory Compliance Requirements

The Medical Billing Market is increasingly influenced by stringent regulatory compliance requirements. Healthcare providers must adhere to various regulations, such as HIPAA and the Affordable Care Act, which necessitate accurate billing practices. Non-compliance can lead to severe penalties, thus driving the demand for efficient medical billing services. As regulations evolve, the need for specialized billing solutions that ensure compliance becomes paramount. This trend is reflected in the market, where the demand for compliance-focused billing software is projected to grow significantly. In fact, the market for compliance management solutions within the medical billing sector is expected to reach substantial figures, indicating a robust growth trajectory. Consequently, companies that can offer solutions that align with these regulatory demands are likely to thrive in the Medical Billing Market.