Market Share

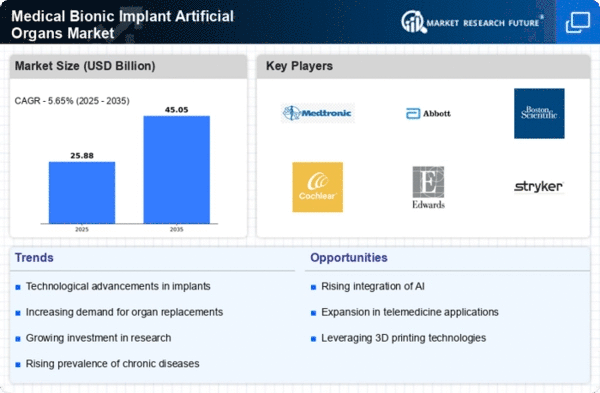

Medical Bionic Implant Artificial Organs Market Share Analysis

The health sector Medical Bionic Implant/Artificial Organs Market is growing rapidly and this has brought about intense rivalry among companies as they seek to position themselves in the market. Firms do different things in order to gain advantage over their rivals, especially on the dynamic landscape. One of these approaches entails differentiation through technological innovation. Companies invest heavily in research and development, which ensures that they come up with cutting-edge bionic implants and artificial organs that have better performance, more features and improved outcomes for patients.This strategy of innovation attracting advanced solution-seeking healthcare professionals positions the company as a technological leader while building its brand image as well.

Further, it should be noted that strategic partnerships/collaborations determine how much market share one gets into. In many cases, firms enter into alliances with research institutions, academic centers and other industry players to exploit collective expertise and resources. Collaborative efforts facilitate knowledge sharing thus speeding up the process of developing new medical bionics implants. Partnerships with healthcare providers and insurers also help in penetrating markets so that more people can use advanced technologies. For instance, if a company establishes networks of collaborations there will be greater access to market and stronger competitive position.

Market share positioning within Medical Bionic Implant/Artificial Organs Market also depends on price competitiveness; thus it is another important element for consideration. However, companies need to find ways of striking balance between producing high quality products while at the same time charging affordable prices. Pricing strategies that take into account economic considerations such as constraints of both individual consumers and healthcare systems improve wider accessibility (Lau et al., 2012). This move tends to broaden customer base by enhancing reputation of being socially responsible entity hence boosting customer loyalty.

Furthermore, effective marketing and branding strategies are essential to carve out a distinctive market share. Companies spend quite some good amounts of money trying to develop compelling brand narratives around their own medical bionic implants which tell stories of how lives have been changed. A company can create emotional connection with healthcare professionals among others by aligning its messaging with patient success stories. This not only helps differentiate its brand from competitors but also confirms the idea that the firm is dedicated to innovative healthcare solutions thereby improving people’s lives.

In addition, geographical expansion forms a significant part of market share positioning in the Medical Bionic Implant/Artificial Organs Market. Many companies customize their strategies depending on regional healthcare needs, regulatory landscapes and cultural differences. By understanding and adapting to diverse market conditions, firms will establish strong presence in key regions hence giving them competitive advantage over non-adaptable competitors (Fleisher & Bensoussan, 2015).

Leave a Comment