Medical Gloves Size

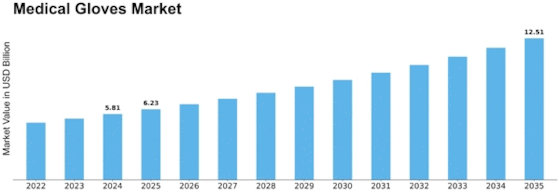

Medical Gloves Market Growth Projections and Opportunities

The incidence of global fitness emergencies, which include the COVID-19 pandemic, has had a profound effect on the medical gloves market. The heightened consciousness of infection control measures and the elevated use of gloves for personal safety have driven a surge in demand for them, influencing marketplace dynamics. The ordinary boom in healthcare expenditure globally has contributed to the growth of the medical gloves marketplace. Healthcare centers allocate sizable assets to ensure the safety of healthcare specialists and patients, resulting in sustained demand for medical gloves. Ongoing technological improvements in material technology have led to the improvement of superior and effective medical gloves. Innovations in materials, including nitrile gloves offering advanced electricity and latex alternatives to address allergies, contribute to the evolution of the market. The growing cognizance of infection prevention measures in healthcare settings has been a good-sized market aspect. Healthcare experts and establishments prioritize the usage of gloves as a fundamental part of contamination control, sustaining the demand for medical gloves. The growth of healthcare offerings globally, including increased healthcenter infrastructure and outpatient facilities, has contributed to the growth of the medical gloves market. The broader reach of healthcare offerings results in the higher consumption of gloves throughout diverse clinical settings. Increased attention to the dangers associated with cross-infection in healthcare settings has driven the demand for medical gloves. Healthcare experts and the general public understand the significance of the use of gloves to prevent the transmission of infections, impacting marketplace dynamics. The disposable nature of medical gloves contributes to continuous demand for them. Disposable gloves are a key element of single-use protective systems, and their convenience and effectiveness in preventing move-infection sustain their tremendous use in clinical settings. Public fitness preparedness tasks and government efforts to stockpile essential clinical elements affect the medical gloves market. Preparedness measures ensure a geared-up supply of gloves at some point during fitness crises or emergencies, shaping market resilience. The globalization of supply chains has both fantastic and challenging implications for the medical gloves marketplace.

Leave a Comment