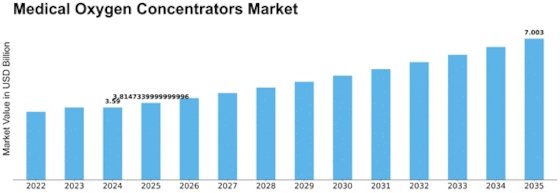

Medical Oxygen Concentrators Size

Medical Oxygen Concentrators Market Growth Projections and Opportunities

The Electric Vehicle (EV) Charging Management Software Platform Market is experiencing a dynamic shift driven by various market factors. One of the primary drivers is the global surge in electric vehicle adoption, fueled by increasing environmental awareness and government initiatives promoting sustainable transportation. A popular approach is centered on technological differentiation. In developing advanced and efficient battery technologies, electric truck manufacturers seek to increase the range of ECVs while improving overall performance. While keeping its lead in technological innovation companies aim at attracting businesses and fleet operators interested in environmentally friendly but still reliable vehicles.

Environmental awareness is one of the main motors in European electric trucks market, which makes manufacturers focus on eco-friendly properties. With a growing focus on sustainability among European countries and the introduction of strict emission norms, electric trucks attract more attention. Manufacturers advocate themselves by emphasizing the environmental advantages of their electric truck models that attract companies who make a priority to decrease carbon footprint. Companies that manage to present their trucks as environmentally friendly vehicles will be able to benefit while the interest for green transportation options rises.

Pricing strategies are also central in determining the market share position for electric trucks within Europe. Even though the electric trucks usually cost more than their traditional counterparts, manufactures strive to achieve economies of scale and cost efficiency in order to make their electric models competitive. Furthermore, other firms take advantage of the incentives and subsidies provided by various European governments in order to provide more competitive prices for potential buyers. The determination of market share position in the area resulting from electric trucks requires balancing initial investments with long-term savings on operational expenses.

In the European electric trucks market, collaborations and partnerships are widespread as manufacturers frequently work with battery suppliers technology companies infrastructure providers among other. These partnerships expedite electric truck innovation and commercialization by sharing resources and knowledge. Besides, partnerships contribute to the development of an integrated ecosystem that consists of charging infrastructure and service offering as well as technological support.

Access to charging infrastructure also forms an important component of market share positioning. The electric truck manufacturers arrange strategically positions where the charging stations are placed and partner with governments as well as private institutions to increase network coverage along transport corridors.

The competition for market share in the European electric trucks segment relies on marketing and brand positioning. In the efforts to develop awareness, markets use targeted marketing campaigns regarding benefits of electric trucks like lower emissions and operational costs as well compliance issues surrounding environmental protection. Communicated effectively, these benefits build a brand reputation and establish trust among customers’ decisions to purchase. Integrating these clean energy sources with EV charging stations becomes essential for creating a sustainable and environmentally friendly charging ecosystem. Software platforms that enable the integration of renewable energy sources into the charging infrastructure are gaining traction, aligning with the broader goals of reducing dependency on non-renewable energy.

Leave a Comment