Healthcare Infrastructure Development

The ongoing development of healthcare infrastructure in South America is a significant driver for the medical oxygen-concentrators market. Governments and private sectors are investing in healthcare facilities to improve access to medical services. For instance, initiatives to enhance hospital capacities and establish specialized respiratory care units are underway. This expansion is expected to increase the availability of medical oxygen-concentrators in hospitals and clinics, thereby boosting market demand. Furthermore, as healthcare systems modernize, the integration of advanced technologies in oxygen therapy is likely to enhance treatment outcomes. The medical oxygen-concentrators market could see a growth trajectory of approximately 7% as these infrastructure improvements take effect.

Rising Prevalence of Respiratory Disorders

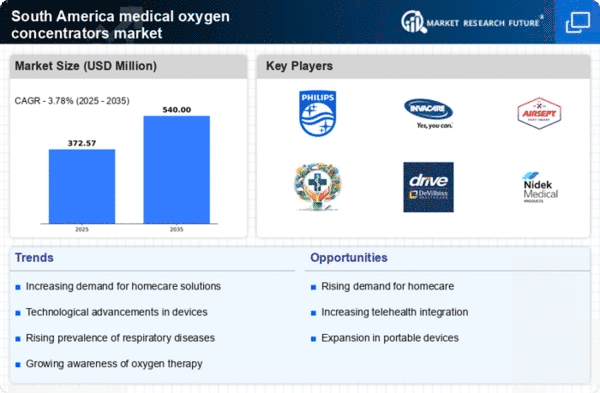

The increasing incidence of respiratory disorders in South America is a primary driver for the medical oxygen-concentrators market. Conditions such as chronic obstructive pulmonary disease (COPD) and asthma are becoming more prevalent, affecting millions. According to health statistics, approximately 10% of the population in certain South American countries suffers from chronic respiratory diseases. This growing patient base necessitates the availability of medical oxygen-concentrators, as they provide essential support for patients requiring supplemental oxygen. The demand for these devices is expected to rise, potentially leading to a market growth rate of around 8% annually. As healthcare systems adapt to these challenges, the medical oxygen concentrators market is likely to expand significantly to meet the needs of patients.

Rising Awareness of Oxygen Therapy Benefits

There is a growing awareness among healthcare professionals and patients regarding the benefits of oxygen therapy, which is positively impacting the medical oxygen-concentrators market. Educational campaigns and outreach programs are being implemented to inform the public about the importance of oxygen therapy for managing chronic respiratory conditions. This increased awareness is likely to lead to higher adoption rates of medical oxygen-concentrators, as patients become more informed about their treatment options. Additionally, healthcare providers are increasingly recommending these devices as part of comprehensive care plans. As a result, the market may experience a growth rate of around 6% as more individuals seek effective solutions for their respiratory health.

Technological Innovations in Oxygen Concentrators

Technological advancements in the design and functionality of oxygen concentrators are driving the medical oxygen-concentrators market in South America. Innovations such as portable devices, improved efficiency, and user-friendly interfaces are making oxygen therapy more accessible. Manufacturers are focusing on developing lightweight and compact models that cater to the needs of patients who require mobility. Furthermore, the integration of smart technologies, such as connectivity features for remote monitoring, is enhancing the appeal of these devices. As a result, the medical oxygen concentrators market is likely to witness a surge in demand for modern solutions for their oxygen therapy needs, with an anticipated growth rate of 9%.

Aging Population and Increased Demand for Home Care

The demographic shift towards an aging population in South America is influencing the medical oxygen-concentrators market. As the elderly population grows, the demand for home healthcare solutions, including oxygen therapy, is expected to increase. By 2025, it is projected that over 15% of the population in several South American countries will be aged 65 and older. This demographic is more susceptible to respiratory issues, thereby driving the need for portable and efficient oxygen-concentrators. The convenience of home care solutions aligns with the preferences of this age group, who often seek to maintain independence. Consequently, the medical oxygen concentrators market is expected to grow as manufacturers innovate to provide user-friendly devices tailored for home use.