Market Share

Medical Telemetry Market Share Analysis

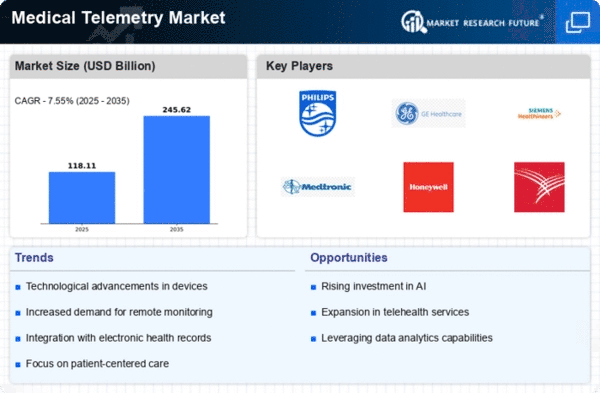

The Medical Telemetry market, a vital component of the healthcare industry, focuses on wireless communication technologies to monitor and transmit patient data in real-time. As competition intensifies, companies adopt various market share positioning strategies to gain a competitive edge. The companies work upon highlighting their over medical telemetry devices by adding futuristic attributes like increased precision of data, easy to understand console, and integration with other health care systems. Innovative product serves to interest such customers as healthcare providers that are interested in advanced solutions. Some company makes it their speciliaity to serve niche segments such as cardiac telemetry or remote patient monitoring to seize a distinct market share. Companies can become the leaders of interesting segments in the sphere of healthcare through specialization in development of certain products capable of meeting the needs required in the areas of specialization. As for market positioning, price competitiveness is a critical point. There is also some cost leadership strategy, whereby companies deliver quality medical telemetry solutions whose value for money is cheaper than its competitors. This method attracts health care centers intent on saving money but still striving for quality, effective solutions. Market leaders tend to go global specifically to access the emerging markets that are seeing a rising need of healthcare. Firms can establish more foreign markets which will widen their customer base while as well providing an opportunity to work with foreign health care practices. A company can improve its market position by relying on collaborations and partnerships with other healthcare stakeholders, namely, hospitals, research institutions, and technology companies. Through entering into joint ventures, companies are able to break into new markets and share cost, share traffic and can also combine their respective complementary skills. Due to the confidentiality of information, companies that focus on effective information security and law adherence in healthcare gram the market. Ensuring reputation of the company as security and compliant provider is a significant responsibility since it will convince health professionals and users to choose these products. To maintain competitiveness in such a dynamic profession as the medical telemetry it is essential to be innovating constantly. Companies which invest substantially in R&D may employ advanced technologies that will set their products to be leading in the market. One of the strategic features is flexibility in products which permits customization to satisfy particular needs of a healthcare facility. Scalability, allowing development of telemetry solutions as a healthcare institution enlarges, attracts organization’s seeking long-term cooperation with technology providers. Clinicians organizations come up with educational programmes to teach the healthcare professional on how medical telemetry is beneficial and how it should be effectively implemented. Apart from improving the market position of an organization, training programs and education resource allows companies’ improvement of the usage of telemetry solutions.

Building a reputation for exceptional customer support and service quality is essential. Timely technical assistance, regular software updates, and proactive maintenance contribute to customer satisfaction, fostering long-term relationships and solidifying a company's position in the market. The medical telemetry landscape is dynamic, with constant technological advancements. Companies that demonstrate agility in adopting and integrating the latest technologies, such as artificial intelligence and machine learning, can stay ahead of the competition and offer state-of-the-art solutions.

Leave a Comment