Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in the US is driving significant growth in the network telemetry market. As more devices connect to networks, the need for effective monitoring and management becomes paramount. IoT devices generate vast amounts of data, necessitating advanced telemetry solutions to analyze and interpret this information. The network telemetry market is expected to benefit from the increasing deployment of IoT technologies across various sectors, including healthcare, manufacturing, and smart cities. With the market for IoT devices projected to exceed $1 trillion by 2025, the demand for telemetry solutions that can handle the influx of data is likely to rise. This trend underscores the importance of robust network telemetry systems in managing the complexities associated with IoT integration.

Rising Network Complexity

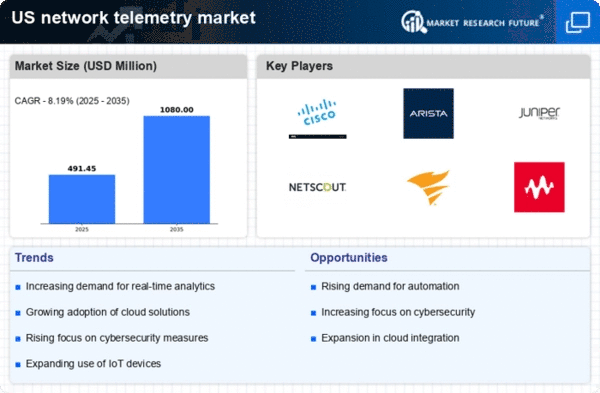

The increasing complexity of networks in the US is a primary driver for the network telemetry market. As organizations expand their digital infrastructure, they face challenges in managing diverse devices, applications, and services. This complexity necessitates advanced monitoring solutions to ensure optimal performance and security. According to recent data, the network telemetry market is projected to grow at a CAGR of 15% through 2027, driven by the need for real-time insights into network operations. Companies are investing in telemetry solutions to gain visibility into their networks, enabling them to identify issues proactively and enhance overall efficiency. The demand for sophisticated analytics tools that can process vast amounts of data is also on the rise, further propelling the network telemetry market forward.

Regulatory Compliance Requirements

In the US, stringent regulatory compliance requirements are significantly influencing the network telemetry market. Organizations must adhere to various regulations, such as HIPAA and PCI DSS, which mandate the monitoring and reporting of network activities. This compliance landscape compels businesses to invest in telemetry solutions that provide detailed insights into their network operations. The network telemetry market is expected to see a surge in demand as companies seek to ensure compliance while minimizing risks associated with data breaches. The financial implications of non-compliance can be severe, with potential fines reaching millions of dollars. Consequently, organizations are prioritizing investments in telemetry technologies to maintain compliance and protect sensitive information, thereby driving growth in the network telemetry market.

Growing Demand for Real-Time Analytics

The growing demand for real-time analytics is a significant driver of the network telemetry market in the US. Organizations are increasingly seeking immediate insights into their network performance to make informed decisions quickly. Real-time analytics enable businesses to respond to issues as they arise, minimizing downtime and enhancing user experience. The network telemetry market is poised for growth as companies invest in solutions that provide real-time data visualization and analysis. According to industry forecasts, the market is expected to grow by 20% annually as organizations prioritize agility and responsiveness in their operations. This trend highlights the critical role of telemetry solutions in facilitating real-time decision-making and optimizing network performance.

Increased Focus on Operational Efficiency

The pursuit of operational efficiency is a crucial driver for the network telemetry market in the US. Organizations are increasingly recognizing the importance of optimizing their network performance to reduce costs and enhance productivity. By leveraging telemetry solutions, businesses can gain valuable insights into their network operations, enabling them to identify bottlenecks and streamline processes. This focus on efficiency is reflected in the projected growth of the network telemetry market, which is anticipated to reach $5 billion by 2026. Companies are adopting telemetry tools to automate monitoring and reporting, allowing IT teams to focus on strategic initiatives rather than routine maintenance. As a result, the network telemetry market is likely to experience robust growth as organizations seek to enhance their operational capabilities.