-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TYPE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- RISING AWARENESS ABOUT MEDICAL TOURISM AMONG PATIENTS

- LOW COST OF MEDICAL TREATMENT IN DEVELOPING COUNTRIES

-

RESTRAINTS

- ISSUE WITH PATIENT FOLLOW-UP AND POST-SURGERY COMPLICATIONS

- QUALITY, SAFETY, AND ETHICAL CONCERNS

-

OPPORTUNITY

- EXPANSION OF TELEMEDICINE AND VIRTUAL CONSULTATIONS

- CROSS-BORDER COLLABORATIONS AND HOSPITAL PARTNERSHIPS

-

INDUSTRY TREND ANALYSIS

-

REGULATORY ENVIRONMENT & COMPLIANCE

-

MARKET TRENDS & INNOVATION

-

MARKET ENTRY & EXIT BARRIERS

- BARRIERS TO ENTRY

- BARRIERS TO EXIT

-

PRICING ANALYSIS & REIMBURSEMENT DYNAMICS

- PRICING ANALYSIS

- REIMBURSEMENT DYNAMICS

-

PARTNERSHIPS & COLLABORATIONS

-

PESTLE ANALYSIS

- POLITICAL FACTORS

- ECONOMIC FACTORS

- SOCIAL FACTORS

- TECHNOLOGICAL FACTORS

- LEGAL FACTORS

- ENVIRONMENTAL FACTORS

-

PORTER'S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS (PATIENTS)

- INTENSITY OF RIVALRY

-

CASE STUDY ANALYSIS

-

INVESTMENT & FUNDING SCENARIOS

-

Medical Tourism Market, BY COUNTRY

- THAILAND

- INDIA

- MEXICO

- TURKEY

- MALAYISA

-

QUALITATIVE DATA ON MEDICAL TOURISM ESPECIALLY THE DENTAL TOURISM DATA

- THAILAND

- INDIA

- TURKEY

-

QUALITATIVE ANALYSIS OF LEADING ECONOMIES IN MEDICAL TOURISM

- INDIA

- THAILAND

- SINGAPORE

- MEXICO

-

MAJOR OUTBOUND MEDICAL TOURISM ANALYSIS, 2024

-

Medical Tourism Market, BY TREATMENT TYPE

-

OVERVIEW

-

ORTHOPAEDIC

-

OPHTHALMOLOGY

-

ONCOLOGY

-

COSMETIC SURGERY

-

CARDIOVASCULAR

-

DENTISTRY

-

NEUROLOGY

-

FERTILITY

-

OTHERS

-

Medical Tourism Market, BY SERVICE PROVIDER

-

OVERVIEW

-

PUBLIC

-

PRIVATE

-

Medical Tourism Market, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

-

EUROPE

- GERMANY

- FRANCE

- UK

- ITALY

- SPAIN

- REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

-

REST OF THE WORLD

- MIDDLE EAST

- AFRICA

- SOUTH AMERICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

MARKET SHARE ANALYSIS, 2024

-

COMPETITOR DASHBOARD

-

PUBLIC PLAYERS STOCK SUMMARY

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- RECOGNITION

- FACILITY EXPANSION

-

COMPANY PROFILES

-

APOLLO HOSPITALS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BUMRUNGRAD INTERNATIONAL HOSPITAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BANGKOK HOSPITAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIE

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

RAFFLES MEDICAL GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

ASKLEPIOS KLINIKEN GMBH & CO. KGAA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

MOUNT ELIZABETH HOSPITALS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCT OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

MEDANTA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

MANIPAL HEALTH ENTERPRISES PVT LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

FORTIS HEALTHCARE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SAMITIVEJ HOSPITAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- SERVICES OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

DATA CITATIONS

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY REGION, 2019–2035 (USD MILLION)

-

Medical Tourism Market, BY REGION, 2019-2035 (USD MILLION)

-

Medical Tourism Market, BY REGION, 2019-2035 (VOLUME IN PROCEDURE)

-

Medical Tourism Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Medical Tourism Market, BY COUNTRY, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

NORTH AMERICA: MEDICAL TOURISM MARKET, FOR FERTILITY, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

NORTH AMERICA: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

US: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

US: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

US: MEDICAL TOURISM MARKET, FOR FERTILITY, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

US: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

CANADA: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

CANADA: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

CANADA: MEDICAL TOURISM MARKET, FOR FERTILITY, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

CANADA: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

Medical Tourism Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Medical Tourism Market, BY COUNTRY, 2019-2035 (VOLUME IN PROCEDURES)

-

EUROPE: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

EUROPE: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

EUROPE: MEDICAL TOURISM MARKET, FOR FERTILITY, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

EUROPE: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

GERMANY: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

GERMANY: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

GERMANY: MEDICAL TOURISM MARKET, FOR FERTILITY, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

GERMANY: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

FRANCE: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

FRANCE: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

FRANCE: MEDICAL TOURISM MARKET, FOR FERTILITY, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

FRANCE: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

UK: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

UK: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

UK: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

UK: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

ITALY: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

ITALY: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

ITALY: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

ITALY: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

SPAIN: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

SPAIN: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

SPAIN: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

SPAIN: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

REST OF EUROPE: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: Medical Tourism Market, BY TREATMENT TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (USD MILLION)

-

REST OF EUROPE: MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019-2035 (VOLUME IN PROCEDURE)

-

REST OF EUROPE: Medical Tourism Market, BY SERVICE PROVIDER, 2019-2035 (USD MILLION)

-

ASIA-PACIFIC: Medical Tourism Market, BY COUNTRY, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: Medical Tourism Market, BY COUNTRY, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

ASIA-PACIFIC: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

CHINA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

CHINA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

CHINA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

CHINA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

INDIA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

INDIA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

INDIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

INDIA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

JAPAN: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

JAPAN: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

JAPAN: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

JAPAN: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

AUSTRALIA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AUSTRALIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AUSTRALIA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

SOUTH KOREA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH KOREA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH KOREA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF ASIA-PACIFIC: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF ASIA-PACIFIC: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: Medical Tourism Market, BY COUNTRY, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: Medical Tourism Market, BY COUNTRY, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF THE WORLD: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF THE WORLD: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

MIDDLE EAST: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MIDDLE EAST: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MIDDLE EAST: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

AFRICA: Medical Tourism Market, BY COUNTRY, 2019–2035 (USD MILLION)

-

AFRICA: Medical Tourism Market, BY COUNTRY, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

AFRICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

AFRICA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

TUNISIA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

TUNISIA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

TUNISIA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

MOROCCO: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

MOROCCO: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

MOROCCO: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

KENYA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

KENYA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

KENYA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

KENYA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

EGYPT: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

EGYPT: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

EGYPT: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

EGYPT: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AFRICA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

REST OF AFRICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

REST OF AFRICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

REST OF AFRICA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: Medical Tourism Market, BY TREATMENT TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 ((VOLUME IN PROCEDURE)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (USD MILLION)

-

SOUTH AMERICA: GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, 2019–2035 (VOLUME IN PROCEDURE)

-

SOUTH AMERICA: Medical Tourism Market, BY SERVICE PROVIDER, 2019–2035 (USD MILLION)

-

RECOGNITION

-

FACILITY EXPANSION

-

APOLLO HOSPITALS: SERVICES OFFERED

-

APOLLO HOSPITALS : KEY DEVELOPMENTS

-

BUMRUNGRAD INTERNATIONAL HOSPITAL: SERVICES OFFERED

-

BUMRUNGRAD INTERNATIONAL HOSPITAL: KEY DEVELOPMENTS

-

BANGKOK HOSPITAL: SERVICES OFFERED

-

RAFFLES MEDICAL GROUP: SERVICES OFFERED

-

ASKLEPIOS KLINIKEN GMBH & CO. KGAA: SERVICES OFFERED

-

MOUNT ELIZABETH HOSPITALS: SERVICES OFFERED

-

MEDANTA: SERVICES OFFERED

-

MANIPAL HEALTH ENTERPRISES PVT LTD: SERVICES OFFERED

-

FORTIS HEALTHCARE: SERVICES OFFERED

-

FORTIS HEALTHCARE: KEY DEVELOPMENTS

-

SAMITIVEJ HOSPITAL: SERVICES OFFERED

-

SAMITIVEJ HOSPITAL: KEY DEVELOPMENTS

-

-

LIST OF FIGURES

-

GLOBAL MEDICAL TOURISM MARKET: STRUCTURE

-

MEDICAL TOURISM MARKET: MARKET GROWTH FACTOR ANALYSIS (2024-2035)

-

DRIVER IMPACT ANALYSIS (2024-2035)

-

RESTRAINT IMPACT ANALYSIS (2024-2035)

-

PORTER'S FIVE FORCES ANALYSIS: GLOBAL MEDICAL TOURISM MARKET

-

Medical Tourism Market, BY TREATMENT TYPE, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET, Medical Tourism Market, BY TYPE, SEGMENT ATTRACTIVENESS, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET SHARE (%), BY TREATMENT TYPE, 2024

-

Medical Tourism Market, BY SERVICE PROVIDER, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET SHARE (%), BY SERVICE PROVIDER, 2024

-

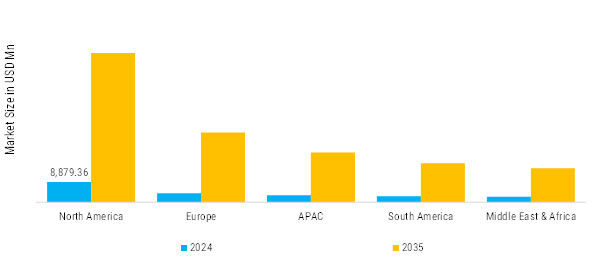

Medical Tourism Market, BY REGION, 2024 & 2035 (USD MILLION)

-

GLOBAL MEDICAL TOURISM MARKET SHARE (%), BY REGION, 2024

-

NORTH AMERICA MARKET ANALYSIS: MEDICAL TOURISM MARKET, 2019-2035 (USD MILLION)

-

Medical Tourism Market, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

NORTH AMERICA MEDICAL TOURISM MARKET SHARE (%), BY COUNTRY, 2024

-

EUROPE MARKET ANALYSIS: MEDICAL TOURISM MARKET, 2019-2035 (USD MILLION)

-

Medical Tourism Market, BY REGION, 2024 & 2035 (USD MILLION)

-

EUROPE MEDICAL TOURISM MARKET SHARE (%), BY COUNTRY, 2024

-

ASIA-PACIFIC MARKET ANALYSIS: MEDICAL TOURISM MARKET, 2019-2035 (USD MILLION)

-

ASIA-PACIFIC: Medical Tourism Market, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

ASIA-PACIFIC: Medical Tourism Market, BY COUNTRY, 2024 (%)

-

REST OF THE WORLD MARKET ANALYSIS: MEDICAL TOURISM MARKET, 2019-2035 (USD MILLION)

-

REST OF THE WORLD: Medical Tourism Market, BY COUNTRY, 2024 & 2035 (USD MILLION)

-

REST OF THE WORLD: Medical Tourism Market, BY COUNTRY, 2024 (%)

-

GLOBAL MEDICAL TOURISM MARKET PLAYERS: COMPETITIVE ANALYSIS, 2024

-

COMPETITOR DASHBOARD: GLOBAL MEDICAL TOURISM MARKET

-

APOLLO HOSPITALS: FINANCIAL OVERVIEW SNAPSHOT

-

APOLLO HOSPITALS : SWOT ANALYSIS

-

BUMRUNGRAD INTERNATIONAL HOSPITAL: FINANCIAL OVERVIEW SNAPSHOT

-

BUMRUNGRAD INTERNATIONAL HOSPITAL : SWOT ANALYSIS

-

BANGKOK HOSPITAL: FINANCIAL OVERVIEW SNAPSHOT

-

BANGKOK HOSPITAL: SWOT ANALYSIS

-

RAFFLES MEDICAL GROUP: FINANCIAL OVERVIEW SNAPSHOT

-

RAFFLES MEDICAL GROUP: SWOT ANALYSIS

-

ASKLEPIOS KLINIKEN GMBH & CO. KGAA: FINANCIAL OVERVIEW SNAPSHOT

-

MEDANTA: FINANCIAL OVERVIEW SNAPSHOT

-

FORTIS HEALTHCARE: FINANCIAL OVERVIEW SNAPSHOT

-

FORTIS HEALTHCARE: SWOT ANALYSIS

Leave a Comment