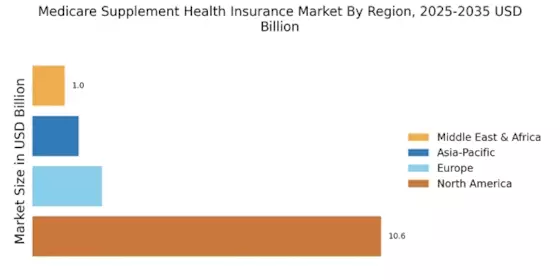

North America : Market Leader in Medicare Supplements

North America, particularly the United States, is the largest market for Medicare Supplement Health Insurance, holding approximately 75% of the global market share. The growth is driven by an aging population, increasing healthcare costs, and a rising demand for supplemental coverage. Regulatory catalysts, such as the Affordable Care Act, have also played a significant role in shaping the market landscape. The competitive landscape is characterized by major players like UnitedHealth Group, Anthem, and Aetna, which dominate the market. These companies offer a variety of plans tailored to meet the diverse needs of seniors. The presence of established insurers and a well-regulated environment further enhance market stability, making North America a focal point for Medicare Supplement Health Insurance.

Europe : Emerging Market with Growth Potential

Europe is witnessing a gradual increase in the demand for Medicare Supplement Health Insurance, driven by an aging population and rising healthcare costs. The market is expected to grow, with countries like Germany and France leading the way, holding approximately 15% and 10% of the market share, respectively. Regulatory frameworks are evolving to support supplemental insurance, enhancing consumer access and awareness. Germany stands out as a key player in this market, with a robust healthcare system and a growing number of private insurers entering the space. The competitive landscape includes both local and international players, creating a dynamic environment. As European countries adapt to demographic changes, the Medicare Supplement market is poised for significant growth, attracting investments and innovations.

Asia-Pacific : Rapidly Growing Insurance Sector

The Asia-Pacific region is emerging as a significant player in the Medicare Supplement Health Insurance market, driven by increasing life expectancy and a growing middle class. Countries like Japan and Australia are at the forefront, collectively holding about 10% of the market share. Regulatory support and rising healthcare awareness are key drivers of this growth, as governments encourage private insurance to complement public healthcare systems. Japan, with its advanced healthcare infrastructure, is a leader in this market, while Australia is witnessing a surge in demand for supplemental plans. The competitive landscape is becoming increasingly diverse, with both local and international insurers vying for market share. As the region continues to develop economically, the Medicare Supplement market is expected to expand significantly, offering new opportunities for insurers.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa region presents an untapped market for Medicare Supplement Health Insurance, with a growing awareness of the need for supplemental coverage. The market is still in its infancy, with countries like South Africa and the UAE leading the way, holding approximately 5% of the market share. Factors such as increasing life expectancy and a rising middle class are driving demand, while regulatory frameworks are gradually evolving to support private insurance initiatives. South Africa is emerging as a key player, with a mix of local and international insurers entering the market. The competitive landscape is characterized by a lack of established players, providing opportunities for new entrants. As healthcare systems improve and consumer awareness grows, the Medicare Supplement market in this region is poised for future growth, attracting investments and innovations.