Growth of Renewable Energy Sources

The Medium Voltage Switchgear Market is significantly influenced by the growth of renewable energy sources. As countries strive to meet their energy transition goals, the integration of solar, wind, and other renewable technologies into the power grid is becoming increasingly common. This shift necessitates the use of medium voltage switchgear to manage the variable nature of renewable energy generation. Market analysis indicates that the demand for switchgear solutions tailored for renewable applications is expected to rise sharply, with projections suggesting a growth rate of over 7% in this segment alone. The ability of medium voltage switchgear to facilitate the seamless integration of renewables into existing grids is crucial for achieving energy sustainability and reliability. Consequently, manufacturers are focusing on developing specialized switchgear products that cater to the unique requirements of renewable energy systems.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly shaping the Medium Voltage Switchgear Market. Governments and regulatory bodies are implementing stringent safety regulations to ensure the reliability and safety of electrical systems. This has led to a heightened focus on the design and manufacturing of medium voltage switchgear that meets these evolving standards. Manufacturers are compelled to invest in quality assurance and testing processes to comply with regulations, which in turn drives innovation in product development. Market data indicates that adherence to safety standards can enhance the marketability of switchgear products, as end-users prioritize safety and reliability in their purchasing decisions. As a result, the emphasis on regulatory compliance is likely to foster a competitive landscape, encouraging manufacturers to differentiate their offerings through superior safety features and certifications.

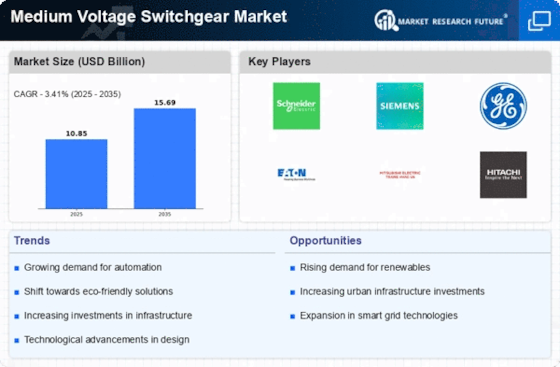

Increasing Demand for Reliable Power Supply

The Medium Voltage Switchgear Market is experiencing a surge in demand for reliable power supply solutions. This trend is driven by the growing need for uninterrupted electricity in various sectors, including industrial, commercial, and residential applications. As urbanization accelerates, the pressure on existing power infrastructure intensifies, necessitating the deployment of advanced switchgear systems. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth is indicative of the increasing investments in power distribution networks, which are essential for maintaining a stable and efficient energy supply. Furthermore, the integration of smart grid technologies is likely to enhance the operational efficiency of medium voltage switchgear, thereby reinforcing its importance in modern power systems.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are key drivers of the Medium Voltage Switchgear Market. As populations migrate towards urban centers, the demand for robust electrical infrastructure increases. This trend is particularly evident in emerging economies, where rapid urban growth necessitates the expansion and modernization of power distribution networks. The market is witnessing substantial investments in infrastructure projects, which are expected to boost the demand for medium voltage switchgear. Recent estimates indicate that the infrastructure sector could account for a significant portion of the overall market growth, with projections suggesting an increase of approximately 5% annually. This growth is further supported by government initiatives aimed at enhancing energy access and reliability in urban areas, thereby creating a favorable environment for medium voltage switchgear manufacturers.

Technological Advancements in Switchgear Design

Technological advancements are playing a pivotal role in shaping the Medium Voltage Switchgear Market. Innovations such as digital switchgear, which incorporates advanced monitoring and control capabilities, are becoming increasingly prevalent. These technologies not only improve the reliability and efficiency of power distribution but also facilitate predictive maintenance, reducing downtime and operational costs. The introduction of eco-friendly materials and designs is also noteworthy, as manufacturers strive to meet stringent environmental regulations. Market data suggests that the adoption of these advanced technologies could lead to a significant reduction in energy losses, thereby enhancing the overall performance of medium voltage switchgear systems. As a result, stakeholders are likely to invest heavily in research and development to stay competitive in this evolving landscape.