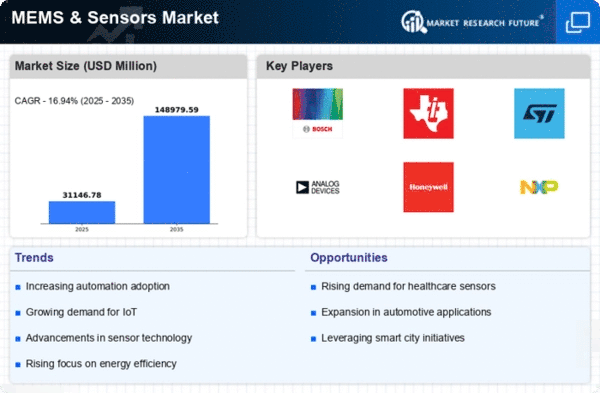

Top Industry Leaders in the MEMS & Sensors Market

Competitive Landscape of MEMS Sensors Market

The MEMS (Microelectromechanical Systems) sensors market is a dynamic and rapidly evolving one, driven by the miniaturization, cost-reduction, and performance advancements inherent in this technology. Understanding the competitive landscape within this market is crucial for established players and new entrants alike. This analysis delves into the key strategies adopted by leading players, factors influencing market share, the emergence of new competitors, and the overall competitive scenario.

Some of the MEMS Sensors companies listed below:

- ASE Technology Holding Co. Ltd.

- AMS AG

- Robert Bosch GMBH

- Qualcomm Technologies Inc.

- Seiko Epson Corporation

- Texas Instruments Inc

- Silex Microsystems.

- Teledyne Technologies

- Sony Corporation

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- X-FAB Silicon Foundries SE

- Infineon Technologies

- Denso

- Avago Technologies

- Sensata

- Measurement Specialties Inc

- Analog Devices Inc

- STMicroelectronics N.V.

Strategies Adopted by Players:

-

Technological Differentiation: Players compete fiercely on innovative sensor technologies, miniaturization, and integration capabilities. Sensor fusion, advanced calibration algorithms, and AI-powered data analysis are gaining traction. -

Product Portfolio Diversification: Expanding offerings beyond core sensor types (accelerometers, gyroscopes, pressure sensors) is crucial. Addressing diverse application needs like healthcare, automotive, and industrial automation fuels market penetration. -

Strategic Partnerships and Collaborations: Partnerships with device manufacturers, software developers, and system integrators enable access to new markets, accelerate product development, and enhance customer solutions. -

Focus on Sustainability: Reducing power consumption, utilizing recycled materials, and implementing resource-efficient manufacturing processes are becoming increasingly important.

Factors for Market Share Analysis:

-

Revenue Generated: This straightforward metric reflects a company's market penetration and financial strength. -

Unit Shipment Volume: Understanding the number of sensor units sold provides insight into customer adoption and market reach. -

Technological Innovation: Assessing a company's investment in R&D, patent portfolio, and technological breakthroughs helps gauge its future competitive edge. -

Customer Satisfaction: Analyzing customer feedback and loyalty metrics reveals how effectively a company caters to customer needs and builds brand reputation.

Latest Company Updates:

December 7, 2023- Murata Manufacturing announces its collaboration with Google to develop next-generation LiDAR sensors for autonomous vehicles using micro-mirror technology.

November 16, 2023- Infineon Technologies introduces its XENSIV™ PAS CO2 sensors, offering high accuracy and long-term stability for indoor air quality monitoring in smart buildings.

October 24, 2023- Bosch Sensortec unveils its BMI389, a miniaturized 6-axis Inertial Measurement Unit (IMU) with low power consumption, targeting wearable and mobile applications.